Energy Compliance and Carbon ConsultingWe help you comply with all energy legislation compliance

Our Energy Consultants

Our expert energy services team provides a full suite of mandatory reporting requirements to support your energy compliance requirements, help you reduce the cost of compliance and maximize your financial benefits. We can provide a full range of solutions to help you manage your legal requirements in an effective and straight forward way.

We can help support the following areas and are happy to discuss any additional requirements or provide an options appraisal approach if you are unsure of a starting point.

> ESOS – Energy Saving Opportunity Scheme compliance requirements.

> SECR – Streamlined Energy and Carbon Reporting.

> CCA – Climate Change Agreements – We can help you obtain and maintain a substantial reduction in Climate Change Levy costs.

> Min-Met Agreements – Obtain a reduction in RO and FiT charges.

> Management of CRC, CCA, EUETS, CHPQA and any new carbon reporting requirements.

> DECs, EPCs and Air Conditioning Inspections.

Energy Compliance Services

We recently highlighted the proposed changes to carbon reporting and energy compliance, with the new framework aiming to improve the way that businesses report their energy use, while providing them with information to identify how they can reduce their bills.

We prefer to engage with our clients on a consultative approach to energy compliance, and understand if any additional benefits can be gained as part of a holistic review. All to often we will unlock further benefits from fully understanding your business requirements and applying further stress tests to add benefit to any project.

> Scope 1 and Scope 2 emissions reporting

> Scope 3 consulting, capture and reporting

> Baseline carbon reporting

SECR – Streamlined Energy Carbon Reporting ComplianceUsing Robotic Process Automation we automate your annual SECR filing.

The streamlined energy and carbon reporting regulations (SECR) came into effect from the 1st April 2018, but thousands of companies are oblivious to their requirements under this act.

The SECR will replace the previous Carbon Reduction Commitment (CRC), a mandatory carbon emissions reporting and pricing scheme to cover large public and private sector organisations in the UK that use more than 6,000-megawatt hours a year of commercial electricity.

The main difference with the SECR compared to the CRC is that energy information must be included in a companies annual filed accounts.

The only exclusions for organisations meeting these criteria are for those with very low energy consumption of fewer than 40,000-kilowatt hours a year.

There are no exemptions or exclusions for companies holding Climate Change Agreements (CCA) or participating in EU ETS.

Carbon and energy reporting set to be streamlined

The government is consulting on a new “streamlined” energy and carbon reporting framework to replace existing schemes.

The new framework will aim to improve the way that businesses report their energy use, while providing them with information to identify how they can reduce their bills.

It was one of the pledges made within the Clean Growth Strategy, with the consultation.

The proposed package seeks to reduce administrative burdens, raise awareness of energy efficiency, lower bills and save carbon.

Streamlined Energy and Carbon Reporting (SECR) is a mandatory carbon and energy reporting scheme for large UK companies.

Companies within scope need to collect and measure their energy and carbon information and submit this as part of their annual accounts filed with Companies House.

The SECR will apply to all large companies, up to 15,000 in number:

> More than 250 employees

> With an annual turnover of £36 million and a balance sheet greater than £18 million.

The Current Landscape

At present, 5,200 individual eligible businesses and public sector organisations annually report UK energy use and purchase allowances to cover carbon emissions under the CRC Energy Efficiency Scheme.

However, this is set to be abolished once the current phase ends in March 2019 with the government’s simplified framework to be introduced the following month.

The Energy Savings Opportunity Scheme (ESOS) also sees large undertakings audit their energy use, while many businesses also voluntarily participate in other reporting schemes including the CDP.

However, writing in her ministerial foreword, Climate Change Minister, Claire Perry explained that while many companies were reporting emissions, there remained an information gap.

This is made pressing with investors wanting greater disclosure so energy and climate risks and opportunities can be accurately priced and factored into their decisions.

Our Digital Approach to SECR

The Catalyst EaaSi™ PRO makes compliance straightforward as any data collected on costs, carbon emissions and consumption by EaaSi can be downloaded into reports that can be used to comply with a range of industry legislation such as:

ISO50001, ESOS, SECR, Climate Change Agreements (CCAs), MinMet Agreements, DECs, EPCs, CRC, EUETS, CHPQA and any new carbon reporting requirements.

SECR – As the platform captures all invoice information and extracts this for GHG emissions reporting as standard then it is very easy to run any SECR Scope 1 and 2 reports in a matter of seconds.

Additional scope 3 reporting is also available for those organisations that either require this or would like to go to this level of reporting.

Digital SECR Energy Compliance

Learn more about our energy spend management platform and how we can provide a digital SECR reporting solution. Or visit our product site energy-as-a-service site.

Energy Saving Opportunity Scheme

ESOS - Energy Saving Opportunity Scheme

We are now in stage 3 of ESOS with the qualification date for the third phase of the 31st December 2022 and the deadline for notification of compliance to the Environment Agency of the 5th December 2023.

You will not be able to carry out the assessment of your total energy consumption (TEC) as this must include the qualification date of 31st December 2022, however where you know that an energy supply will be included in your significant energy consumption (SEC) you can do the audit work on this supply from January 2023.

An audit needs to have at least one year’s energy measurement, but this can be at any time between 6th December 2022 and the 5th December 2023.

The audit can use data that has been collected at any time during this period provided that the audit itself is carried out no later than 24-months after the data period and the data has not already been used for an audit in ESOS Phase two.

Different energy streams can be audited at different times so the workload can be spread better to suit your business needs. The compliance date (last day) is the 5th December 2023 by which time the participant must have undertaken its ESOS Assessment and notified its compliance to the Environment Agency.

The scheme introduced the need for compulsory energy audits for all large enterprises, to encourage the uptake of cost-effective energy efficiency measures. However, If you have ISO 50001 certification you will be considered to have met the obligations of the ESOS scheme.

ESOS Fact Sheets

All organisations must have complied with the legislation by 5th December 2023 if they are defined as a large enterprise.

> If you have 250+ employees

> If the organisations turnover is £42.5m+

> Or you have a balance sheet of £36.5m+

The scope of the scheme includes energy use in buildings, transport and industrial processes. Under the proposed scheme, businesses will be required by law to engage at least every four years in performing:

> A measurement of energy use

> An on-site energy audit

> Identification of cost-effective energy efficiency recommendations

> Report compliance to the Environmental Agency

There are multiple roots to compliance available to participants of the scheme:

> Commissioning ESOS energy audits through approved ESOS assessors

> Through ISO 50001 certification

> Through Display Energy Certificates (DECs) and accompanying recommendation reports

> Through Green Deal Assessments

To ensure your organisation is accurately informed and is legally compliant with the new legislation, we would encourage you to engage with us in an initial consultation.

Through our understanding of the scheme and experience of energy auditing to the standard required, we are positioned to guide your business through the most straightforward route to compliance with the legislation.

If you would like further information on the scheme please contact us and or team will be happy to advise on how best to prepare and assist with simplifying compliance.

ESOS

Our energy compliance ESOS guides present a clear overview of ESOS, whats required and whats expected.

ESOS Compliance

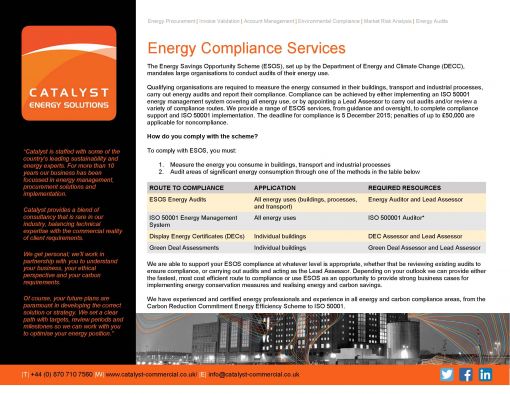

The Energy Savings Opportunity Scheme (ESOS), set up by the Department of Energy and Climate Change (DECC), mandates large organisations to conduct audits of their energy use.

Qualifying organisations are required to measure the energy consumed in their buildings, transport and industrial processes, carry out energy audits and report their compliance.

Compliance can be achieved by either implementing an ISO 50001 energy management system covering all energy use or by appointing a Lead Assessor to carry out audits and/or review a variety of compliance routes.

We provide a range of ESOS services, from guidance and oversight, to complete compliance support and ISO 50001 implementation.

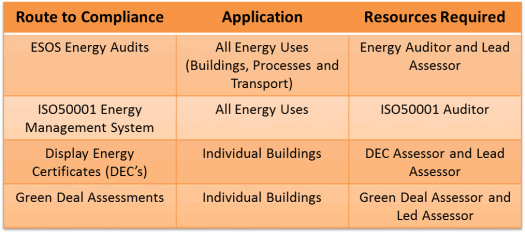

To comply with ESOS, you must:

1. Measure the energy you consume in buildings, transport and industrial processes

2. Audit areas of significant energy consumption through one of the methods in the table below

Most organisations will need to appoint a Lead Assessor, who is an energy professional listed on a register approved by the Environment Agency.

The Lead Assessor can either carry out the audits of the participant’s energy use themselves, or review and sign off audits carried out by others.

There are several routes that can be combined to cover all significant energy use, these are listed below. At least 90% of the total energy consumption (TEC) must be audited.

We are able to support your ESOS compliance at whatever level is appropriate, whether that be reviewing existing audits to ensure compliance, or carrying out audits and acting as the Lead Assessor.

Depending on your outlook we can provide either the fastest, most cost-efficient route to compliance or use ESOS as an opportunity to provide strong business cases for implementing energy conservation measures and realising energy and carbon savings.

We have experienced and certified energy professionals and experience in all energy and carbon compliance areas, from the Carbon Reduction Commitment Energy Efficiency Scheme to ISO 50001.

Life After ESOS – From Report to Implementation

Catalyst can take your ESOS recommendations off the pages of the submission and make them into implemented realities. Combining expert survey and specification, and with access to established sources of funding where needed, we can provide savings based, transparent and simple routes to making ESOS work.

ESOS – Typical Recommendations Include

> Lighting: With double-digit % annual savings possible, Catalyst can survey and complete quotations for full, partial or rolling programmes of an upgrade.

> Building Energy Management Systems: Take control of energy costs.

> Consumption Reporting: Measure, manage and reduce your costs by understanding what you’re using, when, where and what it’s costing.

> Power Factor Correction and Voltage Optimisation: Eliminate the costs on the bill that you don’t have to be paying.

> Strategy: Catalyst can join practice to process to implement a rolling programme of efficiency and cost reduction

> Heat Recovery: Working off detailed thermal surveys, Catalyst can formulate a recovery strategy to recover and re use this valuable commodity

ESOS – Funding Implementation within Savings

Catalyst recognises that organisations want to review the reality of the costs of implementing ESOS and have established routes to finance to cover this need.

Following survey and specification, Catalyst can arrange for finance quotations to be included as a key part of project planning. On many occasions, it will be possible to fund schemes entirely inside their own savings.

Energy Intensive Industries (EII) exemption

Those qualifying organisations can now apply for an Energy Intensive Industries (EII Exemption), and with the exemption providing a discount of up to 85% of the Non-Commodity charges for Renewable Obligation and the Feed-in Tariff it is really worth checking if you qualify.

Based on the latest forecasts for 2019/20 costs, this could be as much as £26 per MWh, so for those qualifying businesses that are using 10GWh of electricity per year, that could equate to a discount of over £225,000.

Eligibility

There are 3 steps to assessing whether a business is eligible to claim compensation for the indirect costs of the Renewable Obligation and Feed in Tariff.

1) The business must manufacture a product in the UK

2) The business must pass the 20% electricity intensity test

3) The business must be within an eligible sector as defined by the 4-digit NACE code

The Mineralogical Metallurgical Exclusion (MinMet)

Depending upon eligibility the MinMet exclusion provides a discounts for CCL charges, and potentially full CCL depending upon processes and methods.

A business can make the most of recent legislative changes by gaining fiscal relief from the CCL, allow our experts to assess your companies viability for a Mineralogical and Metallurgical exclusion and potentially save thousands of pounds.

We will manage the application process while you sit back and receive the benefits.

Climate Change Agreements

A Climate Change Agreement (CCA Scheme) is an agreement between a company and the UK Government, administered by the respective trade body and the Environmental Agency. The CCA scheme represents one of the few successful schemes applied by the government with the intention of reducing carbon in industry, currently in consultation to identify the next stages of carbon reporting.

Introduced in the early 2000’s to increase competitively in the European and Global marketplace after the industry had lobbied Westminster due to increasing non-commodity costs, specifically the 1998 HMRC levy. Upon successful entry, a business is provided with a 90% CCL Rebate on power and 65% on gas.

Understanding your Specific Energy Consumption (SEC)

The need to understand which part of the energy that you use to make your product is critical to the success of your Climate Change Agreement – Every sector agreement is different, some in the way they report i.e. kg per kWh or L per kWh others in the methods that can be applied to their processes i.e. NOVEM.

What is vital is that a business understands what their SEC is and where it is in relation to their sector target.

Measure – Monitor – Manage

The ability to measure a business’s consumption is essential and a requirement of a CCA, the monitoring is required as part of the CCA process and the need to provide returns to the trade bodies.

The management of a business’s energy is the trickiest aspect of a CCA, the old saying, “you can take a horse to water but…..” applies very well here.

Challenges

> Sector Targets

> Project Identification and Costs

> Technological Advancements

Opportunities exist throughout business for energy reduction and the CCA delivers reward for good practice, so the leaner your process the closer you will get to your target and the smaller the fine will be.

Do nothing and potentially you can be removed from the scheme and fined accordingly.

Opportunities

> CCL Relief

> Energy Savings

> Product development

An increase in levy is affecting all sectors both public and private, increases of approx. 65% on 2016 CCL power figures and approx. 73% on Natural gas, and with the increase coming into effect from April 2019 businesses need to act now to be able to receive the increased percentage reduction.

Upon first glance this doesn’t represent a massive increase but taken into context, a business utility bill shows the CCL Charge, this represented approx. 7% in 2016 and from Apr19 this will represent approximately 11%. CCA entry is primed to become even more important post-2019 due to the increases in CCL since 2016 and also the % based increases in the discounts.

Post-2023 – Future Development

The consultation period ends 31st December 2017 for a new annualised carbon reporting scheme. CCA round 3 has not been finalised and the current round runs until 2023, it is anticipated that the penalties will still be carbon-based purchasing but that the targets may be higher.

Minimum Energy Efficiency Standard - (MEES)

A Catalyst guide to the new MEES (Minimum Energy Efficiency Standard) for developers, investors, landlords and lenders. Starting in April 2018, this new legal standard will apply to rented commercial buildings.

The MEES, or (Minimum Energy Efficiency Standard), brings a challenging opportunity for many property owners, developers, lenders and freehold investors.

This guide reviews how the MEES will be implemented, what impact the new legal standard will have on the future and which steps need to be taken now in order to prepare for its implementation.

Minimum Energy Efficiency Standard at a Glance

The MEES was introduced in the Energy Efficiency (Private Rented Property – England and Wales) Regulations in 2015.

Although these regulations were officially released in March 2015, the MEES Regulations originate from the Energy Act of 2011. This Act contained the previous Coalition Government’s package of energy efficiency policies, such as the Green Deal.

Beginning on April 1st, 2018, all landlords that fall within the scope of the MEES regulations are prohibited from renewing existing tenancies and accepting new tenancies.

The regulation states that these prohibitions will be removed later if the landlord’s building acquires a Minimum EPC rating of E or if the landlord registers an exemption.

After 1st April 2023, any landlord that wishes to continue their tenancies must do so in a building that has an EPC rating of E or higher, although exemptions are still admissible even after this date.

The purpose behind the MEES

Building environments have been identified as a major contributor to Greenhouse Gas (GHG) emissions. These GHG pose a threat to the UK’s ability to meet the carbon reduction targets set for 2020 and 2050. It has been estimated by the Government that an estimated 18% of commercial properties hold the lowest EPC ratings of F and G.

MEES takes on the task of improving older building’s EPCs and bringing the energy efficiency standard up to scratch.

Any new buildings are already covered under stringent Building Regulations on any new build properties, to ensure that they meet a certain level of energy efficiency standards as well. It is very important to note that due to this, the minimum standard could potentially rise in the future.

How to know if the MEES applies to you

Figuring out whether or not your building and tenancy will fall within the scope of MEES regulations is a bit tricky.

If you meet the following criteria, the MEES does NOT apply;

> Industrial sites, workshops, non-residential agricultural buildings with low energy demands, temporary properties, holiday lets and a few listed buildings are not required to have an EPC

> Any building that has an EPC over 10 years old

> Tenancies that last less than six months and do not renew

> Tenancies over 99 years

To determine whether or not a building and tenancy are within the MEES scope requires owners to compare the MEES regulations to the Energy Performance of Buildings (England and Wales) 2012. The interplay between the two sets of regulations is complex and thus creates viable loopholes that may be efficiently utilised.

MEES Exemptions

All landlords can continue to maintain tenancies regularly, even if their MEES regulated building falls below the Minimum Energy Efficiency Standard. This is only possible, however, if one of the following exemptions apply;

> Golden Rule – If an independent assessor determines that all energy efficiency improvements have been made or that the relevant improvements would not pay for themselves through energy savings within seven years. A few of these ‘relevant’ improvements include double-glazing and pipework insulation. Furthermore, wall insulation measures are not required if an expert determines that the insulation would damage the fabric of the property.

> Devaluing of Property – If an independent surveyor determines that energy efficiency improvements recommended are likely to reduce the market value of the property by more than 5 percent.

> Third Party Consent – Where consent is not given with conditions that are reasonable to comply with from a tenant, superior landlord or planning authorities.

All of the aforementioned exemptions must be registered with the central government PRS Exemptions Register. To date, an amendment has been tabled to delay the registration to April of 2017. Originally, it was set to go live in October 2016.

These exemptions are landlord and property specific for only five years. This means that if a building receives a new landlord, they will need to acquire their own exemptions for the same building.

Penalties for non-compliance

MEES Regulations are to be enforced by LWMAs (Local Weights and Measures Authorities). LWMAs will have the ability to impose civil penalties which are set by reference to each property’s rateable value.

The penalty for renting out a property that is in breach of the MEES Regulation vary based on the duration of the tenancy. If the rental period is less than 3-months, the charge will be equivalent to 10 percent of the property’s rateable value or a minimum of £5,000. The penalty maximum is capped at £50,000.

If the tenancy runs longer than 3-months, the penalty doubles to 20 percent or a minimum of £10,000 instead. The maximum charge that can be issued is £150,000. Where a building is let despite breaching the MEES Regulations or where a penalty is imposed, the lease will remain valid between the landlord and the tenant.

How to prepare for this challenging opportunity

Landlords will presumably be the ones who feel the effects of the MEES Regulations, as all of the key obligations and restrictions discussed in the MEES fall squarely on their shoulders.

The largest threat to landlords when the MEES starts being implemented is the financial cost of upgrading non-compliant buildings and the potential loss of income from a property that can no longer be rented out.

Provisions in already existing leases may have an effect on the statutory obligations of landlords under the MEES Regulations and may alter landlords position in how they deal with the new legal standard.

Consider the following examples;

> For landlords hoping to delay compliance for as long as possible, their standard leases may no longer contain sufficient restrictions on tenants subletting. This could trigger the landlord’s obligations under MEES.

> A landlord may not be able to recover the capital expenditure required for improvements from the tenant’s lease provisions on service charges, yielding-up, statutory compliance and rent reviews.

> The landlord’s rights to enter may not extend to entry for installing energy efficiency improvements.

> There may also be restrictions in a head lease to consider as well.

> There are opportunities for landlords to engage with tenants in order into enter green leases.

This kind of lease would allow for environmental management and costs of the property, such as energy efficiency improvements or utility bills, that are shared by both parties.

Property Upgrade – Energy Efficient Improvements

Explore the potential to increase rental and asset value through upgrading your property with energy efficient improvements. Combining these additions with other refit upgrades may benefit you and your tenants early on.

As a landlord, evaluate the situation clearly and prepare with the following checklist.

> Audit your portfolio to understand which of your properties are within scope of the MEES Regulations and if you qualify for exemptions

> Perform the energy assessments to see what EPC rating your properties have and that they are up-to-date

> Review how lease terms, planned refit periods, break and renewal dates fit into the MEES timetable

> Understand your rights as a landlord and go over your leases

Preparing for MEES as a Freehold Investor or Developer

Investors who own reversionary freehold assets are not considered landlords within the MEES Regulations where the term of the head lease is over 99-years. However, the regulations will still have an impact.

A key issue to remember is that there is a threat of value reduction of any property assets that do not meet the minimum energy standard.

Furthermore, freehold investors may struggle to find new tenant landlords that are willing to sublet a property if they are required to carry out the energy efficient improvements.

If you are a freehold investor with tenant landlords already in place, however, the MEES will have a different effect. You will actually benefit from having energy improvements made to your reversionary asset, due to the energy saving additions being paid for by your tenant landlords.

As a freehold investor, you may be a landlord in the MEES Regulations if your head lease is less than 99 years. In the event that a property has more than one landlord, the person who is required to pay for the energy efficiency installation is likely to depend on the head lease.

Developers that own freehold assets awaiting development may face similar issues as the freehold investors.

MEES Regulations may have an effect on the timetables of future development programs as well. On the bright side, the new legal standard may provide developers a way to create a profitable opportunity for themselves through the reduction of acquisition costs of property below the minimum standard.

Prepare now by auditing your portfolio, identify which properties may be within the scope of MEES Regulations, and understand how the terms of the head leases and future development programs fit with the MEES timetable.

MEES impact on lenders

Many lenders will also feel the impact of the MEES Regulations.

These regulations are a threat to lenders who have a building that does not meet the minimum standard. This can lead to a reduction in the value of their security and ability to let their properties. This will have an effect on the landlord borrower’s ability to make repayments due to the loss of rental income and any additional capital expenditure costs.

Another threat to lenders occurs when the possession of a property is taken during a default.

During this time lenders can become freehold investors or landlords, making them vicariously subjected to the MEES Regulations.

The absence of a Government scheme to provide finance for landlords (an intention of the Government in 2011) and the MEES Regulations give a unique opportunity for lenders when a landlord needs to borrow money to bring their properties up to the minimum standard.

Lenders may prepare today by reviewing their lending criteria and conditions with the following checklist.

> Obtain sufficient information on the value of the asset.

> Understand the impacts of MEES on their security.

> Correctly price the risk and cost of borrowing.

> Monitor the risk adequately.

Adapt loan monitoring procedures to take in a valid account of the potential risks. For example, mandate that EPC certificates are provided by the borrower on all non-exempt lettings. Or request borrowers to provide a MEES audit or strategy plan before 2018.

Find out if facility agreements provide suitable protections and rights against borrowers who fail to comply with their statutory obligations under the new legal standard.

Preparing for change

As of June 30th, 2016, the Government officially made changes to the law that released the data of commercial property’s EPCs.

Making this data publicly available in bulk was intended to encourage everyone in the property industry to compare the energy efficiency ratings of buildings, as well as influence the decisions that tenants, landlords, investors and lenders make in their property choices.

We are likely to see the beginnings of the market response to this information with the approaching MEES Regulations implementation.

The Energy Performance of Buildings (England and Wales) Regulations 2012 had Amendments added to it in 2015, that require local authorities to report to Government annually on enforcement activities undertaken in relation to EPCs.

Overall, this may deliver more interest in EPCs as well as more active enforcement from LWMAs in the future.

Doubts have been raised as to whether the Government will actually implement MEES since the General Election in May 2015.

This is due to the opposition the policy received from the property industry. Furthermore, Brexit may provide the opportunity to repeal the Energy Performance of Buildings (England and Wales) Regulations 2012, where the MEES Regulations are underpinned, as these were implemented in the EU Energy Performance of Buildings Directive 2010.

Keep in mind, however, that the MEES Regulations originated in the UK and not the EU.

This means that the MEES Regulations remain on the statute books and parties should, therefore, assume that the new legal standard will become official on April 1st, 2018.

Those who have been following the development of the MEES Regulations will be aware that the Government intends to issue detailed guidance on the new legal standard’s application. Many parties, such as the Law Society, are waiting for this guidance before issuing revisions to their current form leases.

Be prepared now for energy compliance MEES Regulations to be implemented.

Failing to understand the MEES timetable and ignoring solid advice in regards to the new legal standard can be devastating.

ISO50001

ISO 50001 energy compliance is the world’s leading international standard outlining best practice energy management to achieve energy efficiency. It provides a structure to measure, monitor and audit energy usage.

We provide third-party certification to prove that your business is managing energy use effectively; that you’re reducing your greenhouse gas emissions; and you’re working to meet environmental targets. Some companies will decide to implement the standard solely for the process and operating benefits it provides.

Others companies decide to get certified to demonstrate to the supply chain and external parties that they have implemented an energy management system.

What does SECR stand for?

SECR stands for Streamlined Energy and Carbon Reporting. It is a mandatory requirement for large companies to record and report annual energy usage.