Experts in Non Commodity ChargesNon-commodity charges make up more than half of a typical business energy bill

60% of an Energy Contract is Non-Commodity

An organisations biggest energy price risk exposure is in non-commodity charges, often refereed to as TPC’s or third party charges. Catalyst can audit and report your future risk exposure on charges and losses associated with delivering electricity to a meter supply point.

Our innovative non-commodity software Cost Stacker™ takes half hourly interval data and de-aggregates it in to all of the component parts that makes up a fully delivered energy bill.

With Non-commodity costs rising year on year, some energy intensive users could see these charges dominate their energy costs over the coming years with energy costs accounting for less than 30% of the total bill value.

For this reason, our Cost Stacker™ product details all non-commodity charges associated with a half hour electricity supply contract.

Increasing Non-Commodity Charges

Validate and Confirm Non-Commodity Charges

With non-commodity costs now accounting for over 60% of a fully delivered energy bill, its really important to understand how future prices will impact your overall energy costs.

Basic Audit Reports

Our basic report provides a 12-month data export view of current or historic contracts, which can be used to compare to an actual supplier’s contract for cost evaluation purposes.

Each report will cover a 12-month period, however multiple reports can be purchased together.

Or you can choose our subscription model, that will provide an ongoing evaluation of non-commodity charges on a quarterly basis.

Past, Current and Future Non-Commodity Charges

For this reason, our Cost Stacker™ product details all non-commodity charges associated with a half hour electricity supply contract. Providing a forecast of monthly non-commodity costs up to 5-years ahead and a historic review of charges for the past 3-years.

Our reports will provide full transparency around these associated costs, and the data can be used to identify your future risk exposure to rising non-commodity charges, or as a pre-tender exercise to evaluate the expectations around non-commodity charges for any current or future energy contract.

The cost of wholesale energy can also be factored into our reports to present a flat price point ahead of any supplier’s margin.

Calculate and Evaluate Your Meter Point Costs

Using your meters half hourly data we can break your profile down into all the component parts that make up your fully delivered energy bill including DUoS Red, Amber and Green bands, Triad risk and the impact of DCP228 and DCP161.

Optimise your Reporting Requirements

We recognise that different organisations have different non-commodity requirements, and as such we provide a choice of services from a single report to a quarterly subscription model with a choice of outputs to suit all budgets.

Digital Report

Our digital non-commodity report provide access to your standalone interactive dashboard with a current and horizon view included as standard.

Third Party Cost Reporting Services

DUoS Calculation

Our non-commodity software can strip out the consumption calculations for both metered and non-metered DUoS charges and then calculate the costs stored in our DUoS cost tables.

Future Budget Forecasting

Non-commodity costs have risen over 10% a year in some regions. So understanding your future costs is an essential part of any budget requirement.

Calculate TRIAD Costs

Transmission Network Use of System (TNUoS) charges covers the cost of installing and maintaining the transmission system. These charges are based on the share of demand on the network during its three peak periods.

Contract Tendering

Through the use of an automated transaction monitoring and risk management system our software can pinpoint the true baseline of non-commodity costs. This is used as a pre-tender service so any supplier offers are based on our own expected cost points.

Heat Map Cost Reports

Our energy cost heat-maps will help you pinpoint non-commodity costs by each half hour period so you can quickly identify potential energy saving hot spots.

Project ROI Calculation

By calculating the true future cost of non-commodity charges it is easier to evaluate the true return on investment. Using the true cost can change a project from not viable to viable.

Non-Commodity Charge Breakdown

What Costs are Associated with Non-Commodity

In order to support renewable generation and other environmental schemes, customers bills include a variety of additional non-commodity charges. Different green charges are applied to gas and electricity bills, renewable subsidies are recovered through only electricity bills. This is because nearly every building in the UK has an electricity connection, but 4mn households are not connected to the gas grid, and many businesses do not have gas connections.

Business electricity bills are subject to the Climate Change Levy (CCL), Renewables Obligation (RO) and Feed-in-Tariff (FIT) Scheme. Gas bills are only subject to the CCL. The RO and FIT Scheme are subsidies paid to large and small renewable generators respectively.

These costs are borne by suppliers who pass them onto consumers bills. The CCL is a charge applied to business energy use in order to encourage energy efficiency, and is only set to increase further as more stringent controls over the levels of carbon use is regulated in the UK.

Non-Commodity Breakdown

Did you know that less than 40% of your energy bill is the cost of your electricity? The remaining 60% is non-commodity charges broken down in the following areas.

Environmental Costs

The small scale FiT subsidy is recovered from suppliers and paid to smaller generators of eligible low carbon and renewable power such as Solar PV and a growing proportion of wind generation also.

Set up in 2002, the Renewable Obligation or RO places a mandatory requirement on licensed electricity suppliers to source a specified and annually increasing proportion of electricity they supply to customers from eligible renewable sources or pay a financial penalty. The RO is currently the main financial mechanism by which the Government incentives the deployment of large scale renewable electricity generation and the energy industry regulator Ofgem administers the scheme. By the 1st October each year the annual obligation on electricity suppliers is published and comes into effect for the next financial year starting on the 1st April.

The Contracts for Difference Feed-in-Tariff (CfD FiT) scheme is the main framework to encourage new low carbon electricity generation in the UK. It replaces the Renewable Obligation scheme which is now closed for any new generation. Generators are awarded contracts through an auction process by which they agree to a strike price for all electricity generated. If the wholesale price is less than the agreed strike price then the generator will receive a top up payment for its energy. If the market price is higher than the strike price, then the suppliers receive a payment.

Capacity Market (CM) – The capacity market, which seeks to ensure the system has enough capacity to meet maximum demand, will come into effect from winter 2017/18. However pilot and start-up costs are being incurred from 2015-16. There are no differences between Small non-domestic and Large non-domestic customer groups.

The Climate Change Levy (CCL) is a business tax on energy delivered to UK energy users. It was originally introduced as an incentive to increase energy efficiency and to reduce carbon emissions.

Delivery Charges

Distribution Use of System (DUoS) charges are distribution network operators (DNOs) charge for the use of their electricity distribution networks. Electricity DNOs charge on a volume basis dependent on the time of day that any electricity is consumed, which is then combined with a daily standing charge and a capacity charge.

Transmission Charges (TNUoS) – Transmission charges recover the cost of installing and maintaining the National Grid electricity transmission system in the United Kingdom. Customers pay a charge based on their location, whether they import or export electricity and the size of their generation or demand.

Transmission losses refers to the energy that is lost as electricity is transmitted over the transmission network. In very simple terms because of the losses you need to buy more to start with to account for these losses.

Much in the same way as transmission losses happen the sames happens at distribution level. As electricity is lost through the various types of connection for example underground or overground cabling will have a very different amount of energy loss.

Industry Charges

Balancing Services Use Of System (BSUoS) Charges – System balancing costs are levied by the system operators for balancing supply and demand on the National Grid. Charges are apportioned on a £/MWh basis; there is one £/MWh price calculated for each half-hour. In recent years these costs have generally been following a rising trend.

Each Balancing and Settlement Code party compensates National Grid for the trading and settlement duties it has performed then paying its share of the costs based on the total volume supplied and or traded.

The Imbalance Price is the price of electricity that generators or suppliers pay for imbalance on the UK electricity grid.

The AAHEDC is a socialised levy to help subsidise the high costs of distributing electricity in Northern Scotland. It is added to all electricity sold from the transmission system to all users in Great Britain.

Other Charges

A Meter Operator or (Electricity MOP Contracts) is only required for half hourly electricity contracts but you must have a valid mop agreement in place if you have this type of supply. This contract covers the supply of the meter, maintenance and the necessary telecommunications for sending consumption data to your chosen energy supplier.

DC is short for Data Collector and DA is short for Data Aggregator. This is a 3rd part company who is responsible for the collection and aggregation of your metered data in accordance with industry standards, ensuring it is compiled ready for settlement.

This agreed amount of electrical load is known as the Agreed Capacity (measured in kVA). To make this capacity available to you, you pay the DNO a set charge to cover the associated investment and maintenance costs. This charge is known as the Availability Charge (measured in £ per kVA).

Understanding Availability Charges

Availability Charging Structure

To understand Half Hourly Availability Charges (sometimes called Capacity Charges or kVA charges) you need to understand two main concepts: Agreed Capacity and Maximum Demand.

Agreed Capacity

When commercial properties are first connected to the electricity distribution network, they are registered as using up to an agreed amount of electrical load. This will be stipulated in the Connection Agreement with the local Distribution Network Operator (DNO) who maintains the electricity network around the properties.

This agreed amount of electrical load is known as the Agreed Capacity (measured in kVA). To make this capacity available to you, you pay the DNO a set charge to cover the associated investment and maintenance costs. This charge is known as the Availability Charge (measured in £ per kVA).

Maximum Demand

The DNO needs to know if you stay within this agreed amount of electrical load. This is measured through your meter, which records your highest consumption in any half hour each month, and this is known as the Maximum Demand. This element is particularly important because if you exceed your Maximum Demand you will be charged at the higher kVA level, either monthly or annually, depending on how your DNO sets their charges.

kVA Fact Sheet

Measuring Demand

Many suppliers present your maximum monthly demand on the invoices; however this only shows the maximum throughout the entire month.

We are able to provide daily analysis on your demand load, and this can potentially identify ways of reducing your available demand requirements.

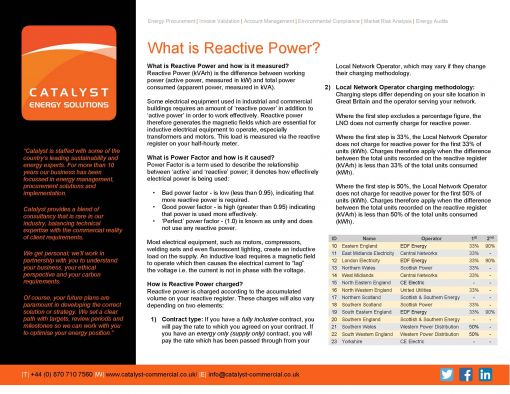

Reactive Power Charges

What is Reactive Power used for

Reactive Power (kVArh) is the difference between working power (active power, measured in kW) and total power consumed (apparent power, measured in kVA). Some electrical equipment used in industrial and commercial buildings requires an amount of ‘reactive power’ in addition to ‘active power’ in order to work effectively.

Reactive power therefore generates the magnetic fields which are essential for inductive electrical equipment to operate, especially transformers and motors. This load is measured via the reactive register on your half-hourly meter.

How is Reactive Power charged?

Reactive power is charged according to the accumulated volume on your reactive register. These charges will also vary depending on two elements:

1) Contract type: If you have a fully inclusive contract, you will pay the rate to which you agreed on your contract. If you have an energy only (supply only) contract, you will pay the rate which has been passed through from your Local Network Operator, which may vary if they change their charging methodology.

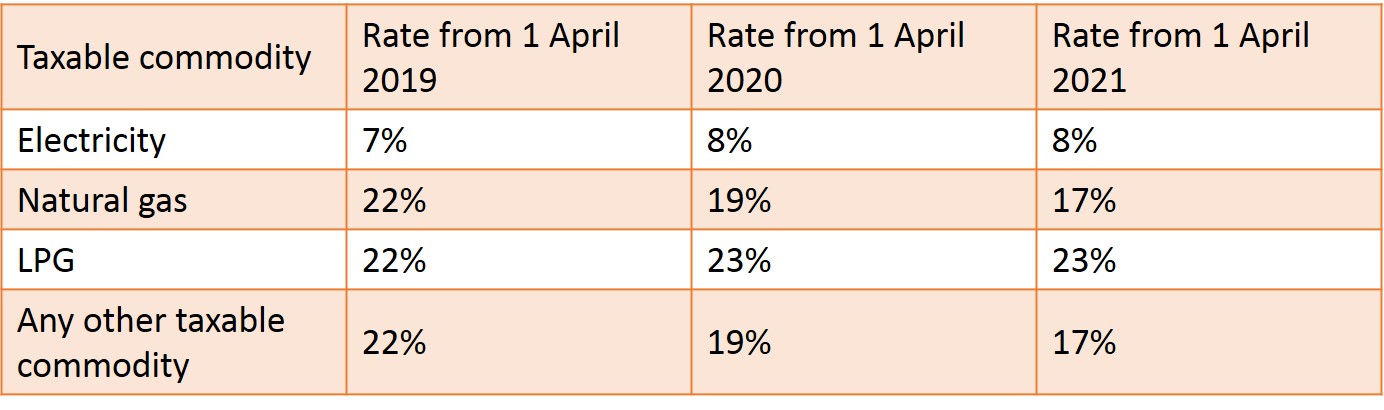

2) Local Network Operator charging methodology: Charging steps differ depending on your site location in Great Britain and the operator serving your network.

Where the first step excludes a percentage figure, the LNO does not currently charge for reactive power.

Where the first step is 33%, the Local Network Operator does not charge for reactive power for the first 33% of units (kWh).

Charges therefore apply when the difference between the total units recorded on the reactive register (kVArh) is less than 33% of the total units consumed (kWh). Where the first step is 50%, the Local Network Operator does not charge for reactive power for the first 50% of units (kWh).

Charges therefore apply when the difference between the total units recorded on the reactive register (kVArh) is less than 50% of the total units consumed (kWh).

Reactive Power Facts

What is Power Factor and how is it caused?

Power Factor is a term used to describe the relationship between ‘active’ and ‘reactive’ power; it denotes how effectively electrical power is being used:

> Bad power factor – is low (less than 0.95), indicating that more reactive power is required.

> Good power factor – is high (greater than 0.95) indicating that power is used more effectively.

> ‘Perfect’ power factor – (1.0) is known as unity and does not use any reactive power.

Most electrical equipment, such as motors, compressors, welding sets and even fluorescent lighting, create an inductive load on the supply.

An inductive load requires a magnetic field to operate which then causes the electrical current to “lag” the voltage i.e. the current is not in phase with the voltage.

Renewable Obligation Charges

Renewable Obligation (RO)

Set up in 2002, the Renewable Obligation or RO places a mandatory requirement on licensed electricity suppliers to source a specified and annually increasing proportion of electricity they supply to customers from eligible renewable sources or pay a financial penalty.

The RO is currently the main financial mechanism by which the Government incentives the deployment of large scale renewable electricity generation and the energy industry regulator Ofgem administers the scheme. By the 1st October each year the annual obligation on electricity suppliers is published and comes into effect for the next financial year starting on the 1st April.

Generators of renewable energy have to report the volume of renewable energy that they generate on a monthly basis to the energy regulator Ofgem. In turn Ofgem then issues ROC’s (Renewables Obligation Certificates) to these electricity generators relating to the amount of eligible renewable electricity they generate.

In turn the generators then sell their ROC’s to suppliers or traders. This allows them to receive a premium in addition to the wholesale electricity price. These suppliers then present these ROC’s back to Ofgem to demonstrate their compliance with the Renewable Obligation.

Suppliers that can not present enough ROC’s back to meet their obligation must pay a financial penalty, which is known as the buy out price. The money that Ofgem collects in this buy out fund is then redistributed on a pro-rata basis to suppliers who have presented ROC’s.

However following a recent change to the RO, electricity suppliers must now ensure that they purchase a higher volume of ROC’S for the year ending 31st March 2014. As a direct result of this, suppliers are set to pass the increased costs on to their customers.

Suppliers will now pass the cost of this compliance with the Renewable Obligation on to consumers through their energy bills. The current cost of the Renewables Obligation (RO) accounts for approximately 20% of the total bill value.

RO Fact Sheet

Renewable Obligation Charges – Proceed With Caution

When comparing offers from suppliers, precaution must be followed when comparing offers as different suppliers have varying terms and conditions to how this Renewable Obligation cost is received.

But unlike the recent introduction of FiT charges, the cost of RO is set out in advance.

The renewable obligation rates that apply to your electricity bill are normally not shown as a separate charge.

DUoS Charging Structure

Distribution Charges (DUoS)

Electricity Distribution Charges

Distribution network operators (DNOs) charge for the use of their electricity distribution networks. Electricity DNOs charge on a volume basis dependent on the time of day that any electricity is consumed, which is then combined with a daily standing charge and a capacity charge.

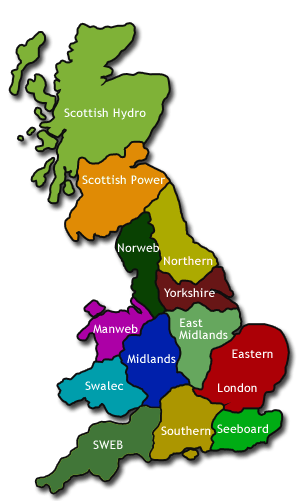

Electricity Distribution Regions

The whole of the UK is split up into 14 areas where one single company the Distribution Network Operator (DNO) has the license to distribute electricity in that area.

They effectively carry electricity from the National Grid (National Level) to the exit point (each has a unique MPAN and a possibility of several meters) where the customers are.

DNO Contacts

In the event of a power failure or when you are looking to connect at a local level you would need to contact your regional DNO.

> Area 10 EDF Energy Networks: 0800 783 8838

> Area 11 East Midlands Electricity: 0800 056 8090

> Area 12 London Electricity: 0800 028 0247

> Area 13 Manweb: 0845 272 2424

> Area 14 Midlands Electricity: 08457 331331

> Area 15 Northern Electric: 0800 668 877

> Area 16 United Utilities: 0800 195 4141

> Area 17 Scottish Hydro: 0800 300 999

> Area 18 Scottish Power: 0845 272 7999

> Area 19 Seaboard: 0800 783 8866

> Area 20 Southern Electric: 08457 708090

> Area 21 Western Power Distribution: 0800 052 0400

> Area 22 SWEB: 0800 365 900

> Area 23 Yorkshire Electricity: 0800 375 675

The owner of the distribution network charges electricity suppliers for carrying the electricity in their network. The regions are based geographically on the old, nationalised electricity board areas.

Contract for Difference Feed-in Tariff

CfD FiT Scheme

The UK has targets in place to source 15% of energy from renewable sources by 2020 and by 2050 to have reduced CO2 emissions by 80% on 1990 levels. But, at least at present, low-carbon electricity is considerably more expensive than electricity produced using fossil fuels, reducing the incentive to invest.

A number of government schemes already exist to make renewable and other low-carbon sources of power generation more economically viable. But when the market price for power rises, low-carbon generators are better able to cover their costs without this financial support. This means that mechanisms such as the Renewables Obligation (RO) and existing Feed-in Tariffs (FiTs) for small-scale generation have the potential to provide generators with significant windfall benefits at consumers’ expense if and when wholesale power prices rise over the medium to longer term.

To address these concerns, the government set out plans as part of Energy Act 2013 to introduce a new scheme intended to incentive low-carbon generation (including nuclear power and carbon capture and storage as well as renewables), while ensuring better value for money for consumers. Known as the Contract for Difference Feed-in Tariff (CfD FiT) scheme, the new mechanism has been designed to provide revenue certainty to low-carbon generators, while ameliorating the possibility for them to achieve windfall profits.

Non-commodity CfD FiTs will provide a subsidy that tops up any shortfall between the amount that the generator receives per unit of electricity sold and a pre-defined “strike price”. This strike price differs by technology but aims to reflect the costs of investing in different low-carbon technologies. Where market prices are less than the strike price, a top up payment is made to the generator. Where these prices exceed the strike price, the generator will be required to pay the surplus back. The result is that generators will not suffer, or unduly benefit from price volatility.

The overall budget for the non-commodity CfD scheme will be split between three technology groups – one for more established technologies (like onshore wind and solar), one for less established technologies (like offshore wind), and a third for biomass conversions. The government’s intention is that the CfD FiT scheme will replace the RO for new plant by 2017, and will apply to all new schemes eligible to receive subsidies under the RO.

Projects wishing to apply for a CfD FiT will have to submit a bid as part of a fixed auction round, representing the lowest strike price per MWh that they would be willing to accept. Those with the lowest bids in each technology group will be allocated CfD FiTs first, continuing with the next cheapest until each budget has been exhausted. The first auctions will take place in October 2014, with an overall funding pot of around £200mn per annum for the period to 2020 once the scheme is up and running.

CfD Fact Sheet

The costs of subsidising this scheme will be charged to all electricity suppliers from April 2015. Costs will then be passed through to customers in their electricity bills. It is estimated that this levy will add around 10p/kWh in 2015-16 and 20p/kWh in 2016-17 to non-domestic energy bills, but steadily increasing thereafter. Consumers should also note that, until 2035, the RO will continue to add an additional cost to electricity bills.

To ensure the UK’s largest businesses are not disproportionately impacted by the introduction of the scheme, the government has set out plans to provide them with relief from CfD FiT costs. In turn to recover these avoided costs, the impact of the relief scheme is estimated contract for difference business rate to be 20p/MWh on the price of electricity for all non-exempt consumers.

FiT Scheme

Business Feed in Tariff (FIT)

Introduced on the 1st April 2010, The Feed in Tariff or FiT scheme is a levy charge imposed by the Government, to fund the Feed in Tariff.

The Feed in Tariff was introduced as an incentive paid to businesses and property owners who generate on site renewable energy through small scale renewable electricity generation.

This additional levy is collected from all energy consumers who are supplied by eligible FiT suppliers. Each supplier is allocated their share of the overall Feed in Tariff costs in proportion to their supply of market share.

The energy industry regulator Ofgem charges energy companies a levy and it is from this levy that the tariff payments are made. The cost of the levy is then passed on to energy consumers by the energy companies so in effect everyone who purchases energy pays for this tariff.

Supplier Pass through Business Feed in Tariff

From the 1st April 2012 a FiT levy has been applied to electricity bills as a direct pass through cost.

So some suppliers have applied these charges to the unit rates and they remain hidden on the customer’s bill.However due to significant increases in the FiT recharge since its introduction in 2010, many suppliers are now adjusting contracted rates to accommodate for these changes in costs.

Other suppliers were not even passing on these charges, and were accounting for any possible increases in FiT charges within fully inclusive energy contracts. This would however probably include a price risk premium to accommodate for any dramatic increase over the life of the contract.

The downside to this solution is that some suppliers didn’t calculate correctly how much the FiT would increase by, and have had to introduce back charging FiT charges to its customers, even after the initial energy supply contract has finished in some cases.

Because this a variable charge and is based on information provided by the Department of Energy and Climate Change (DECC) it is subject to change and will have to be subsequently reviewed and adjusted by suppliers.

Because of these on-going adjustments several suppliers have now decided to split the charges out and charge them on a pass through basis only and will be itemized as a separate line on invoices and labelled as the Feed in Tariff.

FiT Fact Sheet

Business customers need to pay very close attention to how the feed in tariff is included on any quotes, and how this is charged on your invoice. There are huge variations in how energy suppliers are billing for these charges:

Some suppliers are charging on a best estimate basis, and then carrying out reconciliation once the actual rates are known.

Whilst others set a rate which may change going forward, but there are no backdated reconciliations.

Suppliers that take this 2nd option may have to charge a higher initial rate which includes a risk premium to cover any further increases in these charges. So an initial offer may appear more expensive initially when comparing offers against the 1st option. But will have no nasty surprises if the FiT charge increases over the life of the contract.

CCL (Climate Change Levy) Charges

Climate Change Levy (CCL)

The Climate Change Levy (CCL) is a tax on energy delivered to non-domestic users in the United Kingdom.

Its aim is to provide an incentive to increase energy efficiency and to reduce carbon emissions, however there have been ongoing calls to replace it with a proper carbon tax.

Introduced on April 1st, 2001 under the Finance Act 2000 it was forecast to cut annual emissions by 2.5 million tonnes by 2010, and forms part of the UK’s Climate Change Programme. The levy applies to most energy users, with the notable exceptions of those in the domestic and transport sectors.

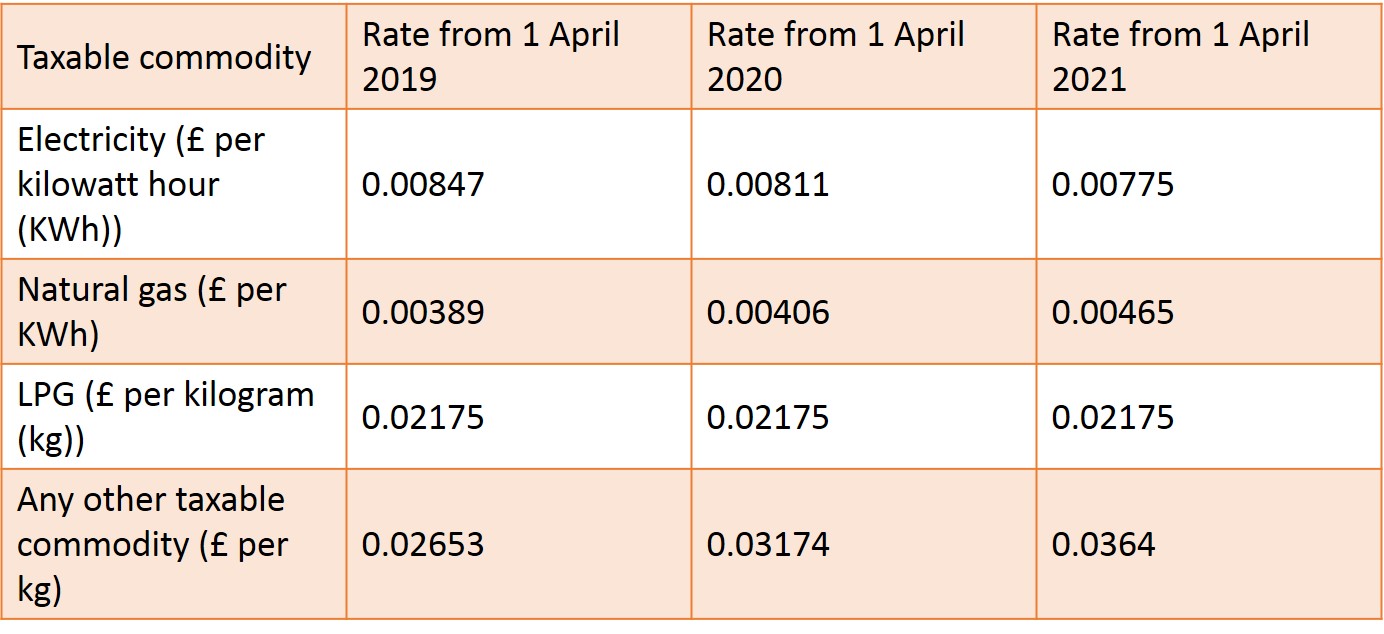

CCL Taxable Non-Commodity

From the 1st April each year the Government increase the Climate Change Levy (CCL). This means that for any energy used where CCL applies, it will be charged at the new rate from this date onward, and on the previous rate prior to this date.

CCL Discounts

Energy-intensive businesses are currently able to receive a 90% discount from the CCL on electricity and 65% on gas through climate change agreements (CCAs). CCAs are voluntary agreements containing targets for increased energy efficiency or reduced emissions. Businesses are exempted from the CCL if they fail to meet the de-minimis consumption requirements of the scheme, of 4,397kWh a month of gas and 1,000kWh a month of electricity.

Overall DECC estimates that medium-sized businesses energy bills are 18% higher than they would be without government policies. Households face slightly different green charges.

They are not subject to the CCL, but they do have to pay for domestic energy efficiency schemes. In addition to green levies, VAT is charged on both domestic and business energy use. Businesses pay the standard VAT rate, 20%, while households and small businesses only pay 5% VAT on energy use.

Latest CCL Prices

Main Rates Of CCL

Discount for Holders of a CCA

Further Advice

HM Revenue and Customs is responsible for publishing the active CCL rates and planed amendments to the rates. A general guide to Climate Change Levy is available at www.hmrc.gov.uk (click on the ‘Environmental taxes’ section of ‘Excise and other’). The CCL is added to energy bills before VAT and, although there is no legal requirement to itemise it, it often appears as a separate item on bills.

Why do electricity non commodity cost increase

Electricity non commodity cost increase all of the time in line with the cost associated with managing and maintaining the national energy supply infrastructure and the various taxes and levies applied to electricity contracts to support the UK's transition towards a more renewable nation.

What are non-commodity costs

These make up the majority of your delivered business energy bill and account for over 60% of the costs. Non-commodity costs cover the cost of delivering energy over the network and various environmental charges to cover the development and subsidies of renewable energy.

How do I calculate non-commodity costs forecast

Its very difficult to do a non-commodity costs forecast, as each meter and region has a different price point associated with it. But our non-commodity software can accurately forecast non-commodity costs for historic, current or future use scenarios.

What makes up non energy cost

Non energy costs are made up of various costs for delivering energy to a customers premises and a range of environmental taxes applied to electricity bills to cover the cost of supporting the development and roll out of renewable generation in the UK.