Business Gas Prices and Gas Suppliers - Compare Gas ProductsQuickly compare business gas prices and tariffs from all UK leading suppliers.

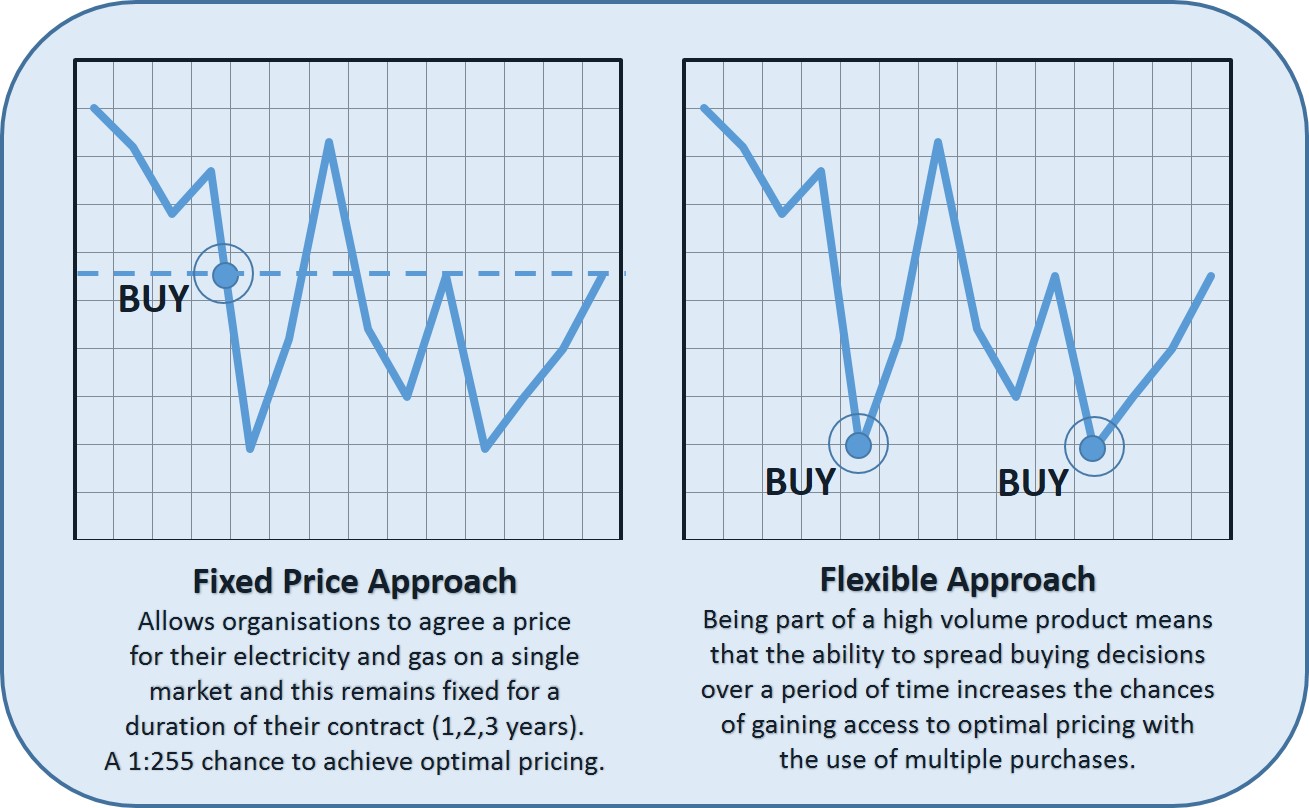

As Award Winning Business Energy Consultants, we provide a fully risk managed flexible gas procurement service to large energy intensive users. Or we can combine your business into a gas portfolio product with other like-minded organisations that are looking to have the ability to spread energy purchasing decisions throughout the life of the contract. Thus, taking advantage of market conditions and helping lower costs and reduce your business gas prices. For those seeking a more traditional fixed gas price approach or a business gas price no standing charge option we have a huge choice of suppliers and options for you.

Choice of Gas Contracts Available

FIXED CONTRACTS

Fixed price energy contracts provide a fixed or semi-fixed price during a set period of time. Contracts can range from 1 to 5-years and allow for one purchasing decision that provides a price based on the prevailing market price. These types of products provide a fixed unit rate for the duration of the contract and are easy to report and track budgets.

FLEXIBLE CONTRACTS

Flexible risk managed contracts provide the framework to make multiple purchasing decisions during the life of the agreement. This requires a robust purchasing strategy which is executed in line with the companies budget requirements. But using live market price access we look to avoid the market highs and take advantage of market lows.

PORTFOLIO

Basket or portfolio products are designed for customers that want to access wholesale energy markets through a flexible contract mechanism. But don’t have the required volume required in order to access them. These products allow you to combine your consumption with other like-minded companies and this combined volume is then wrapped together under one portfolio.

Flexible Gas PurchasingOur range of bespoke flexible gas supply contracts are available to larger gas users.

Optimised Purchasing

We will develop and implement your working strategy to optimise your gas purchasing and hit your business objectives.

Multi-Purchase

Make small multiple purchasing decisions during the life of the agreement.

Professionally Managed

We have our own selection and valuation tools which provide us with an exhaustive search, analysis and monitoring process.

Our range of bespoke flexible gas supply contracts are available to larger gas users looking to take advantage of the full flexibility of the wholesale gas markets. Working with a pre-agreed risk management strategy allows us to make small multiple purchasing decisions during the life of the agreement.

Our award-winning procurement team will work with you to establish your appetite for risk and build a strategy that supports your goals and financial needs.

We will then develop and implement your working strategy to optimise your gas purchasing and hit your business objectives. Our range of bespoke reports will then indicate our trading performance with our trading performance reports and provide analysis against market prevailing conditions.

This along with our weekly and monthly energy market price reports allows you to understand the key drivers influencing the market prices.For those businesses that can take advantage of flexible energy contracts, there is fantastic opportunity to reduce business gas costs, but it does carry an element of risk.

The key to managing that risk is understanding your position in the market and having a robust purchasing strategy that is thoroughly managed. We help manage this whole process for our clients and reduce the risks involved in flexible business gas procurement.

We understand that better analysis makes for better trading decisions, so we use Reuters Eikon to screen market data and intelligence by sector, we then analyse in detail the key fundamentals and drivers in order to evaluate the current and future markets.

We have our own selection and valuation tools which provide us with an exhaustive search, analysis and monitoring process. Eikon, an information distributing system developed by Thomson Reuters provide a unique insight into the energy commodity markets. Thanks to the automatic synchronization provided by the Reuters terminal, we can always keep updated on the latest market news effecting business gas prices.

We can actively monitor the markets for analysis, news, prices, etc and all of this allows us to be more flexible and act quickly in that moment where we should take decisions in order to help our customers in their decision-making processes, such as contract pricing or identifying arbitrage opportunities.

Flexible Gas - Portfolio or Basket SolutionsOur award-winning procurement team have developed an exclusive product that lowers the entry requirements for businesses looking for a flexible gas contract.

Combined Purchasing

Our Business Gas Basket allows you to manage your energy spend more effectively and leverage greater buying power.

Hedging Strategies

Multiple purchases made over time provides greater opportunity to achieve purchasing savings and will spread the risk of a volatile market and the impact on your business.

Professionally Managed

We have our own selection and valuation tools which provide us with an exhaustive search, analysis and monitoring process.

Our award-winning procurement team have developed an exclusive product that lowers the entry requirements for businesses looking for a flexible gas contract. Our Flexible Gas Portfolio solution allows smaller businesses the opportunity to combine their buying power with other companies to get the best gas prices on the wholesale gas market.

This is an in-house risk managed service operating to our own risk strategy allowing us to make proactive purchasing decisions when the market opportunity presents itself throughout the contract duration.

In this way our team reduces the risk of taking one single fixed price, whilst at the same time retaining budget certainty.

This type of product appeals to those business that want to access the wholesale markets that either don’t have the volume to enter them on their own or would prefer the for the purchasing decisions to be made on their behalf to take advantage of changing market conditions.

These are the key features that will appeal to many businesses that are looking to reduce costs and deliver on their financials.

By joining our Flexible Gas Portfolio, you are buying as a group of customers contracted together but import the overall prices are immediately lower than you could achieve individually, due to the reduced risk premiums that suppliers apply to companies within group purchasing plans. You still have the ability to change back from a flexible contract to a fixed contract at any time during the contract period.

Any business that is considering flexible purchasing for the first time will be comforted to know that this product offers complete financial price transparency and together with regular reporting to provide all the information they need to satisfy themselves that they are on target to meet their budgets. A flexible energy contract allows businesses to spread energy purchasing decisions throughout the life of the contract, taking advantage of market conditions and helping lower costs and reduce energy overheads.

The benefits of flexible energy contracts:

No take or pay. Re-forecast consumption throughout the contract term to maximise costs savings and avoid volume tolerance.

Lower risk premiums than fixed term energy contracts.

Multiple purchases made over time provides greater opportunity to achieve purchasing savings and will spread the risk of a volatile market and the impact on your business.

Fixed Term Gas Plans or Fixed Price Gas ContractsThese types of products will guarantee the unit price of gas per kWh for a set period of time.

Choice of Contracts

Fixed products provide a known unit rate for 1,2,3,4 or even 5-years.

Full Supplier Panel

We have a huge choice of tier 1 and 2 business gas suppliers and the best of the independents on our supplier panel.

Award Wining Service

We have a team of award winning energy consultants who are happy to quote for your next commercial gas contract.

These are the most common form of gas contracts and have been the cornerstone of commercial gas contracts for years. Our award-winning procurement team will provide an enormous range of contract options based on a customer’s requirements.

These types of products will guarantee the unit price of gas per kWh for a set period of time and allow companies to have fixed price certainty during the life of the agreement.

Usually between one and five years – protecting you against energy price hikes during this fixed term.

Bridge Gas Contracts

These are still a fixed price solution where the unit price of gas per kWh is set for a period, but with a bridge contract these are normally for a shorter period, in some cases as short as a month.

These reason for having a bridge agreement is normally to bring a site contract date in line with other sites in your portfolio or to allow you to join a new flexible gas arrangement if this starts on a set date.

Using this method it is possibly to have shorter term gas contract for as little as 1-month or using this technique to align a group of gas contracts for one neutral contract end date.

Group Gas Contracts

Our award-winning business gas procurement team have developed a range of services and solutions specifically tailored to those customers who have multiple locations. Customers who have a multi site portfolio normally have the biggest choice of options to choose from. This gives them the choice of either fixed or flex options or a combination of both depending on the requirements.

Business Gas Q&A

Locating your MPRN Number – The first step in getting a new business gas quote is locating your gas MPRN number. A Gas Meter Point Reference Number (MPRN) is a unique number assigned to a business gas meter and is supported by the serial number located on your meter.

An MPRN number consists of a maximum of 10 digits for example MPR: 2558490504 which you can locate from your gas invoice. However Meter Point Reference Number’s that begin with either 74 or 75 indicate that your site is supplied by an Independent Gas Transporter. Independent Gas Transporters usually charge more as this is a privately-owned network such as an industrial estate.

If you can’t find your MPRN on your bill or you have just moved into a new business premises, if you call the National Grid Meter Number Helpline on 0870 608 1524 and provide them with your full address and or serial number from the meter, they will be able to provide this to you.

Confirming Your Annual Gas Consumption – The next step in obtaining a business gas quote is to clarify your annual consumption figure in order to accurately quote for your business. This can be obtained by either obtaining a renewal quote from your existing provider or by a new supplier confirming your annual quantity with Xoserve the central data services provider for Britain’s gas market.

The UK Business Gas Market – With the increasing complexity of the UK energy market, the independent advice offered by business gas brokers and commercial gas consultants will help many energy buyers find the right commercial gas or business gas contract for their business. You may be interested in finding more information on flexible gas products or how you can access the wholesale business gas price for large industrial or commercial gas supplies, or even commercial LPG gas for your business. Wondering whether you can save money by doing your next energy project with Catalyst? Have other questions, comments or want to learn more about our service? Review our Gas Procurement Brochure and an overview of our product selection process.

Simply fill in this form and one of our team members will be in touch shortly, or why not give us a call and we’ll be happy to help. Or perhaps you would prefer to get an instant online gas quote for your business, simply click here to use our online business gas quoting tool.

Every year more and more companies hire the services of an energy broker to help them find a cost effective business gas contract. According to Ofgem over 60% of UK energy and gas contracts are now procured directly through independent energy consultants.

So why do so many business rely on energy consultancy firms like Catalyst to find cheap business gas prices for them.

The answer is fairly simple, decision makers and business owners understand that using independent consultants provides an impartial and fresh approach to evaluate and identify opportunities that can add significant value and improve the business bottom line.

All of our consultants have a vast amount of experience in achieving substantial results for our customers and our unique approach to each case can often point out areas of significant improvement that only a trained pair of eyes can identify.

Sometimes the devil is in the detail and from years of experience we can often identify areas that raise a concern for us to investigate further.

Without a doubt the main reason organisations hire our business gas procurement services, is simply because – it helps reduce costs, increases efficiency and provides hassle free and quick access to a vast amount of suppliers, contract types and of course professional purchasing advice. In addition to this we provide unbiased market intelligence to support any of our recommendations.

Business Gas Meters – There are several different designs of gas meters available depending on the volumetric flow rate of gas required. Such as diaphragm, rotary or turbine. For smaller commercial sites the diaphragm gas meter is the most common, and then for medium users the rotary meter is more common as this can handle higher pressures than a diaphragm meter. Then for large commercial gas users a turbine meter will be in place where gas flow continuity is required.

The Wholesale Gas Markets Explained – The wholesale gas market is where large volumes of gas are traded between producers and suppliers. Suppliers want the gas to sell on to their customers in homes and businesses, while producers want steady cash for the energy they have to sell. There are also traders and speculators who want to buy and sell natural gas to make a profit.

The wholesale market has a significant influence on a consumer’s final bill, with the government estimating that wholesale energy costs make up 47% of the total cost. It is worth noting that over 60% of the increases in household bills since 2010 have come from wholesale price increases.

Suppliers often purchase gas for customer’s years in advance to lock-in prices and ensure they have the gas they require. A margin is then added by suppliers to the wholesale price to provide them with some protection from price changes. These factors can mean that wholesale price changes do not immediately impact consumer bills.

Many factors can influence the prices set in the wholesale market. Oil is often important as many long-term gas contracts are linked to oil prices, while increased demand for heating and light during winter months pushes up prices. Also influential is heightened global demand, which, as a result, contributes to prices rising in the UK.

The GB gas market is both the largest and the most active trading point in Europe. British wholesale gas trading is conducted at the National Balancing Point (NBP), which is a virtual trading hub without a physical location. Trades on the NBP have a minimum size equal to about the average yearly use of 10 households. National Gas Grid is responsible for the management of the gas system as the System Operator for Britain, making sure the amount of gas bought and sold by traders is equal at the end of the day.

How Gas is Distributed Across GB and by Whom – There are four main players involved in transporting gas across the country: the transmission system operator; distributors; shippers; and Xoserve.

Gas enters into GB from numerous different sources: offshore production; imports from other countries; gas storage sites and small amounts of onshore production. It is carried to consumers via two systems across Britain, the National Transmission System (NTS) and the local distribution networks (DNs). The NTS is owned and operated by National Grid. It moves gas from where it is produced to either very large users; such as power stations, or into the local distribution networks. Gas moves at roughly 23 mph through the NTS, meaning it takes about one day for gas to move from one side of the system to the other.

Distribution networks transport gas from the NTS to businesses and households. There are four distribution companies operating in GB: National Grid Gas; Scotia Gas Networks; Northern Gas Networks and Wales & West Utilities. The distribution system is spilt into eight different networks, each covering a different area of GB and owned and operated by one of the distribution companies.

In addition to this there are several independent and privately-owned Gas Transporters (iGTs) who operate networks within GB. iGTs are embedded within the local distribution zones and provide connections from the DNs to customers. iGTs have been operating since competition was introduced in 1995, and now possess roughly 1mn connections.

Distribution and transmission companies charge for gas to move through their pipes, with these charges passed onto consumers bills. Ofgem, the energy regulator, sets price controls which limit the total amount of revenues that transmission and distribution companies can earn. The companies then set their tariffs to recover this money from suppliers. Ofgem estimates that distribution charges make up 16% of a customer’s bill and transmission charges 2%.

Gas shippers purchase gas from producers and pay the transporters to convey it across the country to sell to suppliers. Shippers are not responsible for the movement of gas through the system, they only specify where the gas should enter and exit the transport system. Shippers must ensure they insert as much gas as their customers use in order to balance daily. Administration of the flows is undertaken by Xoserve which operates the IT systems that handle financial transactions involving the gas network companies.

How is Gas Bought and Sold in Great Britain – Gas is traded at the National Balancing Point (NBP) in GB. This is a virtual trading hub; it is not a physical location but allows for standardised contracts to govern trades, making trading easier for market participants. The NBP is very active and liquid hub, the gas is traded numerous times before being actually delivered to the customer. Trades within the GB gas market are made on a number of standardised different time periods, such as: day-ahead, month-ahead or year-ahead.

Gas trading within GB is carried out in several different ways. Shippers as users of the gas pipeline network must input enough gas every day to match their customers’ needs. National Grid as the system operator oversees that shippers’ trading activity translates to a safe pipeline network. National Grid uses the on-the-day Commodity Market (OCM) to ensure the system safety by buying and selling gas to balance the system. Shippers may also use the OCM for trading to make sure their gas inputs match their outputs within the day.

Electronic exchanges allow the buying and selling of gas over short term and screen based prices. There are also brokers who assist shippers with over-the-counter (OTC) trades, bilateral deals between two parties.

Many different parties trade gas in GB. Suppliers trade in order to buy gas to sell on to their customers, so they want to make sure they have enough gas, and that the effect of price rises is minimised. Traders and speculators within the market trade gas as a commodity in order to make a profit. They do not produce or supply any gas; they make money by buying when gas prices are low and selling when gas prices are higher. Producers sell gas in order to make a profit and fund further operations.

Gas commodity trading has a major impact on customers’ bills; wholesale costs make up roughly half of the final bill. Increases in wholesale prices are passed on from suppliers to consumers. Suppliers’ use of different length future contracts allows them to soften the impact of price changes and delay the passing on of these additional costs to consumers.

How Gas is Traded Internationally – A significant proportion of internationally traded gas is done so at prices linked to the oil market. This is because gas is viewed as a substitute fuel in regards to oil, and is often co-located with oil meaning it was efficient to extract both fuels at the same time.

Gas is transported internationally through pipelines from the production location to the area of demand. Due to the resources required to build a pipeline and the potential issues with transporting gas across multiple countries this has traditionally limited the distance over which gas can moved. It also encouraged long-term contracts as produces wanted a predictable demand to cover their investment and consumers sought continuity of supply.

In recent decades however the gas trade has become a more international one through the increasing sophistication and use of Liquid Natural Gas (LNG). LNG is natural gas that has been cooled until it becomes a liquid. This liquid is then transported in large tanker ships, removing the need to for pipelines. Great Britain sources a significant proposition of its gas imports from LNG, LNG accounted for 33.3% of imported gas in Q2 2013, primarily from Qatar. British Gas signed a £4.4bn deal to import up to 3mn tonnes a year of LNG from Qatar for the next 4 and a half years on 6 November 2013. LNG trading has also led to a more global gas price, Japan’s dependence on imported commercial gas due to the nuclear shutdown following the Fukushima disaster has led to higher prices in the.

In the US shale gas production has had a noticeable impact on gas prices. The increase in gas production caused by the shale revolution has caused gas prices to fall significantly. This price fall is a result of the US’s lack of gas export facilities. As the US has historically been geared towards imports it is unable to export the gas, which has resulted in the shale gas flooding the US market. The US is currently building LNG export facilities, with the aim of exporting from 2015, which will likely drive up US gas prices.

Private Gas Networks Explained – The National Transmission System (NTS) transports gas across the UK from where it is produced or imported to the distribution networks. The NTS is owned and operated by National Grid and is a regulated company, with revenues set by the energy regulator and no competitors due to its status as a natural monopoly. The NTS transports gas to the local distribution zones (LDZs), of which there are 12. There are eight different distribution networks, each of which cover a geographical area of GB, and is owned and operated by one of the UK’s four gas distribution network companies.

In addition to this there are several independent Gas Transports (iGTs) currently operating networks including: GTC Pipelines; Independent pipelines; ES Pipelines; Energetics; Fulcrum Pipelines; British Gas Pipelines; and SSE Pipelines. These iGTs operate networks embedded within the local distribution zones.

iGTs are privately-owned networks that have begun operating since the mid-1990s. iGTs provide connections from the existing gas distribution networks to customers, either directly or indirectly through another iGT. iGTs connect to distribution networks through Connected System Entry Points, and their network charges are regulated by Ofgem under the Relative Price Control. This caps charges for new iGT customers to a level broadly similar to what would be charged from a connection via the distribution network.

iGTs serve both households and businesses, although most of their customers are new build housing estates. iGTs normally offer competitive connection rates compared to the distribution companies, and then recover their costs from customers. Customers whose gas is delivered by an iGT typically pay slightly higher bills as suppliers have to pay both the iGT and the distribution network for gas distribution.

Since competition in distribution begun in 1995 private gas networks have grown rapidly, from under 250,000 in 2001 to roughly 1mn connections. Ofgem estimates that roughly 60% of connections to new premises are now made by iGTs.

What are AMR, non-daily metering and daily metering – Flows into and from the GB gas pipeline system must be balanced on a daily basis. National Grid as operator of the National Transmission System (NTS) has strict rules to make sure the pipeline system operates safely. Too much or too little gas in the pipes can cause safety problems. It manages the task daily because it takes gas one day to move from one side of the system to the other. To keep the system safe it is vital that the flow of gas on and off the system is measured.

There are around 2,000 daily read meters at the largest gas consuming sites. They are termed daily metered (DM) and provide an accurate day-to-day record of gas used at the premises which they transmit on for billing.

The vast majority of the 23mn plus gas meters installed within GB are not read daily though. They are termed non-daily metered sites (NDM). For billing NDM sites rely on submitted meter readings to suppliers. NDMs are normally read on a monthly or longer basis, and rely either on customers submitting their own meter reads or supplier representatives coming to the property and taking a reading. Algorithms are used to estimate daily consumption for all NDM loads so that the overall pipeline network can be kept in balance.

NDM sites can opt for automated meter reading (AMR). AMR can provide up-to-date consumption information and communicate directly with suppliers systems. This should enable more accurate and timely billing. However, AMR information is not at the moment used to help system balancing. Suppliers must install AMR meters at all their large non-domestic customers’ premises, those who use 732MWh or more of gas consumption a year, by April 2014.

The government is aiming to have completed a nationwide roll-out of smart meters to households and small businesses by 2020. Through smart metering it is envisaged that daily consumption information will be recorded for small users too. However, it is not clear at this stage how and when information from smart meters might be used to help system balancing.

Wholesale Gas Prices – Understanding how these prices are determined and how they affect individual business users is very important for companies looking to secure the best overall price and product value when deciding which supplier to choose. By really understanding the make up of the market and how key drivers can influence the price of gas, will allow you to save money on your next gas contract now and in the future. And with gas prices seemingly rising all of the time its only when we can understand how these changes can best suit our buying requirements that it becomes less of a gamble.

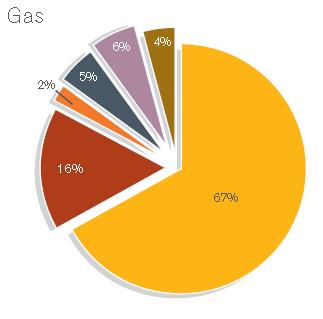

What makes up the cost of a fully delivered contract – While a business receives its bill from its supplier it is actually made up of a number of different costs from a number of different sources. Common principles apply to both gas and electricity bills, which can be broken down into the following broad elements:

Wholesale cost – The wholesale cost is the basic cost of energy; and represents the largest single component of the final bill. Small businesses will likely be charged a fixed cost per unit consumed which is will be stated before the contract is agreed. Large companies with high consumption may have tariffs that track prices with the fluctuations of the wholesale market.

Suppliers’ cost to serve and profit – Suppliers’ price non-domestic contracts individually based on their assessment of the likely costs and their desired profit, which together forms the suppliers’ margin. The final offered margin is based on: the suppliers cost to serve; the duration of the contract; the variability of your load profile; your credit status; and wider market sentiment when your commercial agreement was reached.

Transmission and distribution costs – These represent the cost transporting your energy across the country. The transmission system operator and distribution companies charge suppliers for this, with suppliers recovering these costs from customers. The prices charged by the networks are regulated by Ofgem, with the charges set by the individual companies to ensure they recover their allowed revenues each year.

Government Obligations Costs – These costs stem from government obligations placed on suppliers, which are then passed through to customers. The costs are different for electricity and gas, with the majority of costs applied to electricity bills. Business customers also have the Climate Change Levy added to their bills, a charge applied to per kWh to electricity and gas consumption in order to encourage them to become more energy efficient.

VAT – VAT is normally charged in-line with the standard rate, currently 20% on business customers.

About the Reporting Agencies – The prices that are paid each day and even each second, as sometimes hundreds of trades are made on a single contract in a day are primarily dictated by the PRAs, or price reporting agencies. This is interesting in that these agencies consist of individuals who are consistently checking prices on deals they are given, constantly changing and checking their numbers, and then reporting these wholesale gas prices to the market as a whole. The PRAs are privately owned and help to provide an arbitrary form of agreeing on prices, but it is the prices themselves that keep PRAs in business.

The UK Gas Market – Because of its sheer size and the amount of money that changes hands per year, the UK is home to Europe’s largest gas trading market. This means that other European gas trading hubs often follow the lead set by the contracts that are developed in the UK. However, there are some other factors that may influence wholesale gas prices, including accusations of price-gouging and using abstract excuses to keep the price of not only wholesale gas, but also electricity and oil, abnormally high.

Changing Contract Prices – Another thing that complicates wholesale gas prices is the number of times they change from day to day, or even from hour to hour. There are price variations between contracts and even more variations on the same contract over the course of the day, making the prices even more difficult to pinpoint. Near-term price changes are almost always dictated by supply and demand. As an example, if next week’s forecast is colder, this means that more consumers will turn up their heat. More gas will be used, and the price will go up accordingly.

How Gas Suppliers Buy the Gas That We Use – When consumers receive their commercial gas bills from companies like Npower or British Gas, the final delivered gas prices that are paid by the company are clearly shown. However, there is no indication as to how these prices were determined or how the supplier determines the final cost paid by the end user. These suppliers typically buy their gas in huge contracts with gas wholesalers that cost billions of pounds and last for years, and up until recently, these contract prices were linked to oil rather than to natural gas. The UK has paved the way for such large contracts in dealing with wholesale gas in recent years, and this has exploded into a £300 billion per year industry.

How the Trading Works – While there is still some gas that is bought and sold through the Intercontinental Exchange, or ICE, most of the major deals that occur between suppliers and providers are known as OTC, or over the counter deals. This simply means that a great deal of these gas sales and purchases occur between two parties on their own terms rather than through an entire group. With that being said, these bilateral deals occur while using the NBP, or national balancing point, as a sort of electronic trading post. This daily trading has a huge effect on overall wholesale gas prices and ultimately decides the final price that we end up paying.

Determining the Value of Gas – Once it is understood how the suppliers actually purchase the gas and how the trading itself really works, it is important to consider the ways in which wholesale gas prices can actually be determined. It is relatively simple to look up a publicly traded company and determine its value; the share price provides this information. However, determining the values of the contracts for gas, especially those that occur on the OTC market is a bit more difficult. It involves subscribing to various agencies which make data available regarding these trades that is incomplete, at best. Despite the inaccuracy of the information, the prices paid during these huge deals rely upon it heavily.

What the Suppliers Pay vs. What They Claim – A couple of years ago, an announcement was made in the UK that wholesale gas prices would climb by 25% and cause the prices paid by consumers and even business gas prices to climb significantly. However, the truth in this is limited because there are several different wholesale prices for gas at any given time. The gas that is being purchased by households and businesses right now in the UK may have been purchased last week or it may have been purchased as much as five years ago. Most suppliers will actually spread out these purchases in order to mitigate the risks associated with 25% jumps in the price of gas, as well.

Price Changes among Competitors – Like any other industry, there is more than one supplier that provides gas to households and businesses across the UK. But there are only six main companies providing this commodity, and consumers often feel that there is not enough competition in the market primarily because all of the competitors seem to raise their prices in unison. It is important to remember that the sale of gas is a business and that maximising profits is the name of the game. If one competitor raises prices for whatever reason, the rest will be compelled to either follow suit or cut their prices to remain competitive.

What Consumers Can Do – In the wake of ever-changing wholesale gas prices and the complicated cycles that cause it to occur, there are consumers who feel that they are simply at the mercy of the gas companies. This is not the case, however. As prices rise and fall due to changing contracts, supply and demand, inaccurate reporting or any reason at all, consumers can take action and switch their suppliers often. More often than not, the price jumps reported by the suppliers are not actually passed down; rather, the companies simply want to make money. By constantly choosing to go with the provider offering the lowest prices, it will force the suppliers to take action and work harder to provide more consistent prices in the long run. Although there is a lot that goes into determining wholesale gas prices including how the gas is being traded, the accuracy of the price reporting agencies and even supply versus demand, the consumers and businesses themselves who are the end users of the product often hold the key to ensuring that the prices remain affordable from season to season and even from year to year.

Our Business Gas Services Explained

What makes our business gas service stand out from the competitors is our close but independent relationship with our gas suppliers and our ability to fully understand the diverse range of gas products available on the market today.

UK gas suppliers prefer to deal with a set number of consultants who will manage a large portfolio of clients, rather than having to deal with individual clients directly. Suppliers can then focus on there core business activity of service and delivery of products, whilst the consultants add value and additional support to the standard services offered by the supplier.

We offer a comprehensive comparative quote from a wide range of business gas suppliers and we can quickly deliver a range of gas quotes for your exact business requirements, allowing you to quickly compare your current cost, with our range of business gas quotes.

We can then offer practical advice on the conditions of supply with each contract, and recommend the most suitable contract type and length for your requirements. Taking into account your annual consumption we will provide a detailed breakdown on our proposal allowing you to compare any standing charges and gas prices per kWh in line with your actual consumption levels.

Our business gas service is self-funding as we receive an industry set fee from our gas suppliers allowing you to find you the most commercially viable proposition for your energy needs. In addition, our highly focused approach to business gas procurement allows us to provide gas pricing benchmarks and the ability to evaluate and select the best business gas suppliers, contract lengths and terms in line with wholesale gas market activity.

By fully understanding the key drivers that effect short term and long term gas markets we are able to provide professional advice on how to best proceed with your contract requirements in one of the most volatile trading markets in the world.

Ongoing Business Gas Solutions

Our business gas brokers then maintain a close working relationship between client and the gas suppliers, with your own dedicated Account Manager and free monthly energy reports.

For industrial gas users that have a daily read supply or interoperable gas contracts that give National Grid UK the authority to temporarily cut off gas transmission to your site. We can provide both standard and spot market prices from a range of leading UK commercial gas suppliers.

We are more than a simple business gas comparison service, we work with a range of British business gas suppliers to actively source the cheapest commercial gas rates.

We provide a formal quote on your business gas rates and allow you to simply select a supplier form our business gas price comparison chart and your required business gas rate.

Our industrial gas service is self funded as we receive an industry set fee from the suppliers and we determine your current industrial gas costs against a range of OFGEM approved business gas supplier’s tariffs to find you the most commercially viable industrial gas proposition.

In addition to this we can provide commercial gas pricing benchmarks and the ability to evaluate and select the best industrial gas suppliers, contract lengths and terms, as we have a highly focused process approach to business gas procurement.

Trying to find the cheapest business gas prices for your commercial needs can be a tricky and daunting prospect for the average business owner. Trying to understand which supplier is offering competitive gas prices and how these compare against other offers that have different pricing structures or a multitude of different contract caveats. Review our Gas Procurement Brochure and an overview of our gas product selection process.

To really understand whats going on we must begin to understand how the price of gas operates on the wholesale traded market. So lets take a look at the daily trending fluctuations in the wholesale gas market and look at why this is the most volatile trading market in the world. As you can see from our daily trading gas graph that prices have fluctuated between 40p per therm all the way to over a £1 per therm. You can see from this data that if you choose the wrong time to secure your next gas contract that it can have a huge financial impact on your business.

How can I get a business gas quote?

Using an energy broker can provide access to a wind range of different suppliers and types of contract. Much in the same way as using an insurance broker to find a better deal or compare the market for you.