April 2022 Energy Market BriefThe volatility in wholesale energy prices remains the centre piece for price movement

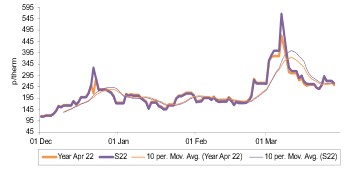

Annual Gas Prices

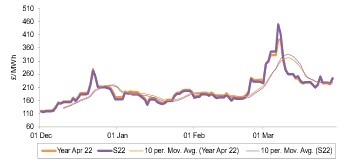

Annual Power Prices

In March GB gas prices resumed their bullish trends, particularly at the start of the month, bolstered by the speculation and introduction of Russian energy sanctions. Prices did ease from the significantly elevated levels achieved at the start of March, as the month matured, helped by easing immediate supply disruption concerns.

On average, seasonal gas contracts from summer 22 to summer 24 were 40.1% higher in March than in the previous month. Gains were seen particularly in the first week of March boosted by announcements of fresh sanctions imposed on Russian energy imports from the west, although prices retreated by the end of the month.

The volatility in wholesale energy prices remains a prevalent and on-going driver, particularly in GB and Europe, driven by speculation and announcements on western sanctions and Russian response, as well as the tight gas supply landscape prior to conflict in Ukraine. Threats of economic and energy related sanctions ramped up future gas supply concerns for forward delivery, evidenced in the sharp rise in the summer 22 gas contract, which lifted ~63% higher (318.06p/th) in March.

There were some record highs within GB gas prices in March too. Day-ahead gas prices eclipsed the previous record price of 415p/th to sit at 580p/th on 7 March, a likely response to fresh economic and energy related sanctions placed on Russia that morning This fuelled the gas supply shortfall concerns of western economies, as they continue to attempt to reduce reliance on Russian energy imports.

Gas price increases impacted the power market too, with most counterpart contracts mirroring gas price movements.

Elsewhere, day-ahead power prices rose 63% in March, to average just over 313p/th, ~595% higher than the same period of 2021.

Seasonal power contracts from summer 22 to summer 24 rose 21.0% on average in March, a consequence of near-term bullish drivers feeding through to longer dated contracts.

Power contracts for both near-term and longer-term delivery saw strong price rises, primarily driven by the strong upward shift seen in gas counterpart contracts. The day-ahead baseload power contract rose by over 54% in March, to average 262.24p/th, well above ‘seasonal norms’ and ~337% higher than the same time in 2021.

Some bullish drivers specific to baseload power price rises though, could be seen in the form of a relatively low output month for wind, particularly by comparison to the record outturn levels seen in February.

Full Report