Energy Market Brief – July 2019Day-ahead gas and power at 20 and 18-month lows

Day-ahead gas declined for the ninth consecutive month, falling 12.1% to average 28.0p/th in June. The contract dropped as low as 25.2p/th on 26 June, a fresh two-year low as forecasts of record-breaking temperatures pressured demand profiles, leaving the gas system oversupplied. June saw an increase in storage withdrawals from the previous month, following a decline in LNG send-out as only five tankers arrived, down from 16 the previous month. Seasonal gas contracts dropped by 1.5% on average, following a second consecutive monthly decline in Brent crude oil prices. Winter 19 gas decreased 5.7% to average 51.3p/th, 8.5% lower than in June 2018 when the contract averaged 56.1p/th.

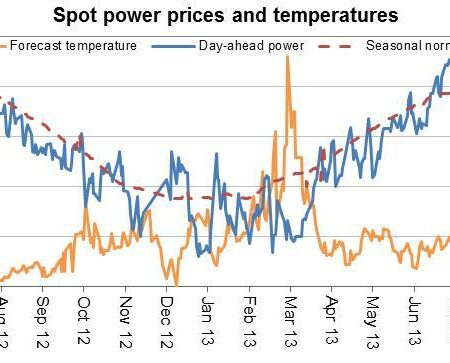

Day-ahead power fell by 4.0% in June to average £39.4/MWh, its sixth consecutive monthly decline. The contract ended the month at £36.1/MWh, a one-month low. Prices have continued to follow the gas market lower, with periods of high wind and solar generation also pressuring prices. All seasonal power prices fell in May, down 1.5% on average. Winter 19 power moved lower by 3.7% to average £55.7/MWh, just 2.0% higher than the contract was a year ago in June 2018 (£54.6/MWh).

Day-ahead gas hits two-year low, all contracts fall

Brent crude oil declined for the second consecutive month, down 10.8% to average $62.9/bl in June. Oil prices peaked at $66.8/bl at the end of June as the G20 summit was expected to have positive outcomes for US-China trade talks. This, in combination with the anticipation that OPEC+ (at its meeting on 1-2 July) would agree to extend production cuts into the second half of the year, were enough to offset reports of record US production which had previously driven prices down.