Energy Market Brief – May 2019Day-ahead gas and power at 20 and 18-month lows

Day-ahead power declined 2.8% in April to average £43.7/MWh, its fourth consecutive monthly decline. The contract dropped to £38.5/MWh on 23 April, a 20-month low. Prices have continued to follow the gas market lower, with periods of high wind generation from Storm Hannah and high solar generation over the Easter Weekend also pressuring prices.

All seasonal power prices rose in April, up 6.0% on average. Winter 19 power was 5.9% higher, averaging £58.8/MWh, 17.8% higher than April 2018 (£49.9/MWh). Day-ahead gas experienced its seventh consecutive monthly decline, down 10.3% to average 35.5p/th in April, dropping to a two-year low of 27.0p/th on 23 April as the gas system was oversupplied amid warm temperatures and low demand. Prices have continued to be pressured by the influx of LNG to GB terminals, with 20 tankers arriving across the month. All seasonal gas contracts recovered in April, rising 4.6% on average as support came from a recovery in Brent crude oil prices. Winter 19 gas was up 5.1% to average 56.2p/th, 11.2% higher than in April 2018 when the contract averaged 50.5p/th.

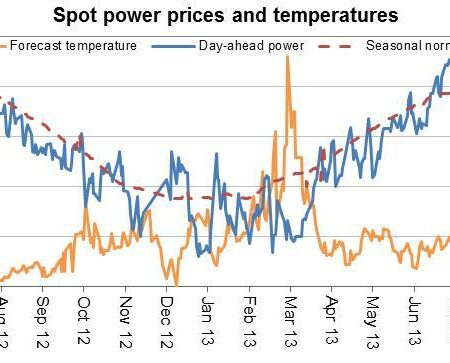

Volatile Energy Prices

EU ETS carbon rose for the second consecutive month, lifting 16.4% to average €25.6/t. Carbon prices rose to €27.9/t on 12 April, a near 11-year high. Prices found support from the approaching compliance deadline on 30 April, which is the last occasion for companies to hand in EUAs to account for emissions in 2018. This drove prices higher as total auction volumes halved in the week leading up to Easter weekend, as no auctions took place on Wednesday 17 April due to a fortnightly break in Polish auctions, and on Good Friday on 19 April.