Energy Market Brief – October 2019Day-ahead gas hits 10-year low, power follows

Day-ahead gas prices fell 10.2% to average 25.4p/th in September. The contract dropped to 19.3p/th on 4 September, a 10-year low, amid the scheduled arrival of several LNG tankers in the month. October 19 gas dropped 4.1% to average 33.4p/th, as supplies are expected to remain comfortable early this winter. Seasonal gas contracts continued to decline, dropping 0.9% on average. However, contracts did see support mid-month as the European Court of Justice overturned a previous ruling that allowed Gazprom to utilise more than half of the capacity of the OPAL pipeline and the Dutch government confirmed plans to cease production at Groningen gas field eight years ahead of schedule in 2022.

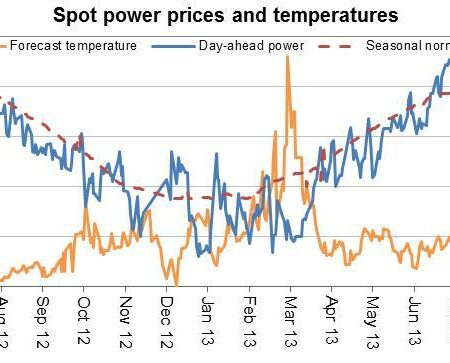

Day-ahead power dropped 5.9% to average £37.3/MWh in September. The contract fell to £30.6/MWh on 3 September, the lowest since 8 September 2016 amid higher renewables output and lower gas and carbon prices. October 19 power fell 3.2% to average £42.9/MWh, dropping as low as £40.9/MWh on 3 September. Seasonal power contracts fell 1.2% on average, with winter 19 power declining 1.2% to £53.3/MWh. The winter 19 power contract hit a near 18-month low of £50.6/MWh on 6 September.

Oil prices find support from Saudi drone attacks, carbon sees volatility

Brent crude oil rose 4.2% to average $62.3/bl in September. Prices rose as high as $68.7/bl on 17 September following news of drone strikes on Saudi Arabian oil infrastructure on 14 September. The strikes knocked out approximately 5.7mn bpd of production, equivalent to 50% of Saudi Arabia’s total production capacity and ~5% of total global output. However, prices soon reversed, ending the month at $61.1/bl as Saudi Arabian oil production recovered quicker than expected and as concerns of slower economic growth weighed.