July 2022 Energy Market BriefRelentless energy prices dont give up momentum

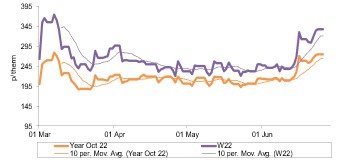

Annual Gas Prices

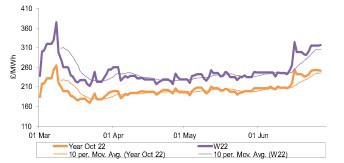

Annual Power Prices

In June, we saw collective gains across all tracked GB gas contracts over the month on average. Volatility across the wholesale gas market remains evident, with varying upward movements across both near-term and longer dated contracts further out on the forward curve.

On average, seasonal gas contracts from winter 22 to winter 24 were 10.8% higher in June compared with the previous month (3.7% average rise in May), with the most significant average price rises concentrated across winter 22 and summer 23 (up 20.8% and 13.8% respectively).

Some of the bullish sentiment for near-term gas contracts can be attributed to periods of higher demand over the gas network, particularly at the months start where temperatures were slightly below seasonal norms. Elsewhere, we also observed periods of heightened outages throughout select plant and gas fields across the Norwegian Continental Shelf (NCS), restricting flows into GB and tightening supply on the gas network as a result.

In support of the aforementioned bullish levers for gas prices, we saw day-ahead gas climb strongly, up 57.5% on average from May to sit at 155.42p/th. Front-seasonal contracts also shared collective average price growth, with July 22 up 2.5% to 183.27p/th and August 22 up 15.1% to average 219.98p/th.

Increases over gas contracts further out on the forward curve into winter 24 were ultimately influenced in part by the strong upward movement of near-term prices.

Moving to power, the month saw day-ahead power prices follow their gas counterpart upwards – 42.4% higher on average to sit at £173.43/MWh. Comparing this with the same period in 2021, that is a 119.0% rise.

Primarily, the strong upward momentum on near-term domestic gas prices set a price direction for power prices to follow, with the highest price rises concentrated towards the end of June, where wind levels dropped too.

Front-month power contracts (July and August 22) shared the ascending price direction of their gas counterpart contracts and day-ahead power prices, subsequently rising 7.3% on average to sit at £193.09/MWh and £207.05/MWh, respectively.

Commodity markets saw mixed price movements, a consequence of the on-going unpredictability of many international markets in recent months, with the Russia-Ukraine war continuing and recession concerns rising. For carbon, the EU ETS fell 2.7% to average €83.72/t, whilst the UK ETS followed suit, down 1.9% to average £81.94/t. Brent crude prices saw price growth last month, up 5.0% to average $117.59, primarily driven by on-going market tightness and continued EU-wide discussions concerning an embargo on Russian oil.