June 2022 Energy Market BriefThe Story of Two Halves as Energy Prices Take Direction

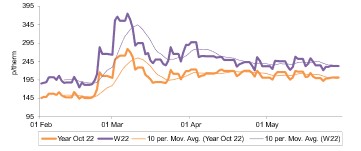

Annual Gas Prices

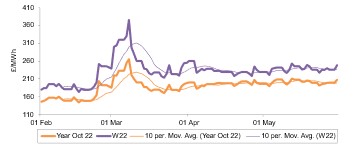

Annual Power Prices

In May, near-term wholesale gas prices declined – most evident across the day-ahead and front-month contracts. However, further out on the forward curve we observed seasonal contracts from winter 23 to winter 24 increase, a likely response to the continuation of risk premiums being baked into future gas delivery, with on-going uncertainty surrounding the future of Russian gas supply.

On average, seasonal gas contracts from winter 22 to winter 24 were 3.7% higher in May than in the previous month. The majority of these seasonal contracts continued to climb as the month matured too.

If we look closer at near-term gas prices across May, there were some evident bearish factors which brought down pricing levels. Firstly, warmer weather trends continued into May from what was already a warm April against seasonal averages, suppressing heating demand in-turn. Similarly, the UK saw an increased volume of LNG cargoes reach GB terminals in the month, subsequently raising domestic LNG send-out and softening the supply demand balance in the short-term.

In support of these bearish movements, the day-ahead gas contract fell 47.8% lower in May – to average 98.67p/th. Similarly, both front month contracts were down an average of 21.9% on the previous month, to sit at 155.31p/th and 178.82p/th respectively.

Gas price losses also impacted the power market too, with most counterpart contracts mirroring gas price movements.

Elsewhere, day-ahead power prices eased 32.6% in May, to average £121.80/MWh, but remained 59.4% higher than the same period of 2021. Seasonal power contracts like their gas counterparts largely increased. Subsequently, seasonal power contracts from winter 22 to winter 24 lifted 8.1% on average compared with April.

Primarily, the strong downward momentum on near-term domestic gas prices set a price direction for power prices to follow, coupled with periods of elevated wind outturn across parts of month softening supply margins slightly.

Front-month power contracts shared the descending price direction of their gas counterpart contracts and day-ahead power prices, subsequently falling 12.4% on average to sit at £168.35/MWh and £185.57/MWh, respectively.

International commodity markets enjoyed a bullish month of price direction in May. For carbon, both the UK and EU ETS schemes recorded growth, with UK ETS prices up 7.4% on the month prior to average £83.50/t, with the EU ETS up 7.8% to average €86.08/t. Elsewhere, Brent crude oil lifted 6.1% to average $111.95/bl – buoyed by globally tight supply markets and EU threats of Russian oil export bans.

Full Report