- August 16, 2017

- Posted by: Catalyst

- Category: Business Energy News

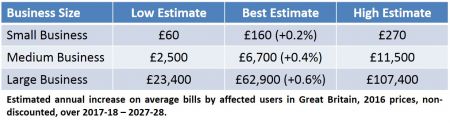

Estimated annual increase on average bills by affected users in Great Britain, 2016 prices, non-discounted, over 2017-18 – 2027-28

Energy intensive industries (EIIs) are to be made exempt from the indirect costs of the Renewables Obligation (RO) scheme, lowering electricity costs for some of the country’s biggest energy users.

While EIIs, such as major manufacturers and the steel industry will benefit, other bill payers are set to see their energy costs increase.

A shifting burden

EIIs had previously been provided retrospective compensation for these costs, funded through general taxation. With the shift to an exemption, costs will instead be recouped from other electricity consumers.

The government estimated non-exempt businesses face increases to their electricity bills of between 0.2% – 0.6% over 2017-18 to 2027-28. With the exemption included, costs are set to be around £18.20/MWh (2016 prices), compared to around £17.40/MWh without the exemption.

The government accepted that businesses outside the exemption face added costs, however it felt the benefits on offer for EIIs justified proceeding.

The exemption focuses on businesses operating in sectors considered to be “at risk” of losing out to international competition, and for whom electricity is a sizeable part of their gross value added. The government explained that by making these EIIs exempt, they benefit from increased certainty when compared to a compensation scheme, and real-time support. It further suggested there could be wider positive impacts on output, investment and employment decisions. The risks of investment and carbon leakage – where businesses relocate abroad for lower energy prices – were also considered to be reduced as a result of the exemption.

The government assured it was still looking to “bear down” on broader business energy costs and what more can be done in the business energy area, referencing ongoing work on the Industrial Strategy and Clean Growth Plan.

The exemption is subject to Parliamentary approval, having secured European Commission State Aid approval, and is intended for implementation from 1 January 2018. If Parliamentary approval is not secured in time this could be delayed.

Government walks a tightrope in redistributing energy costs from large businesses to households, but the news highlights competing pressures across both the economy and energy transition.