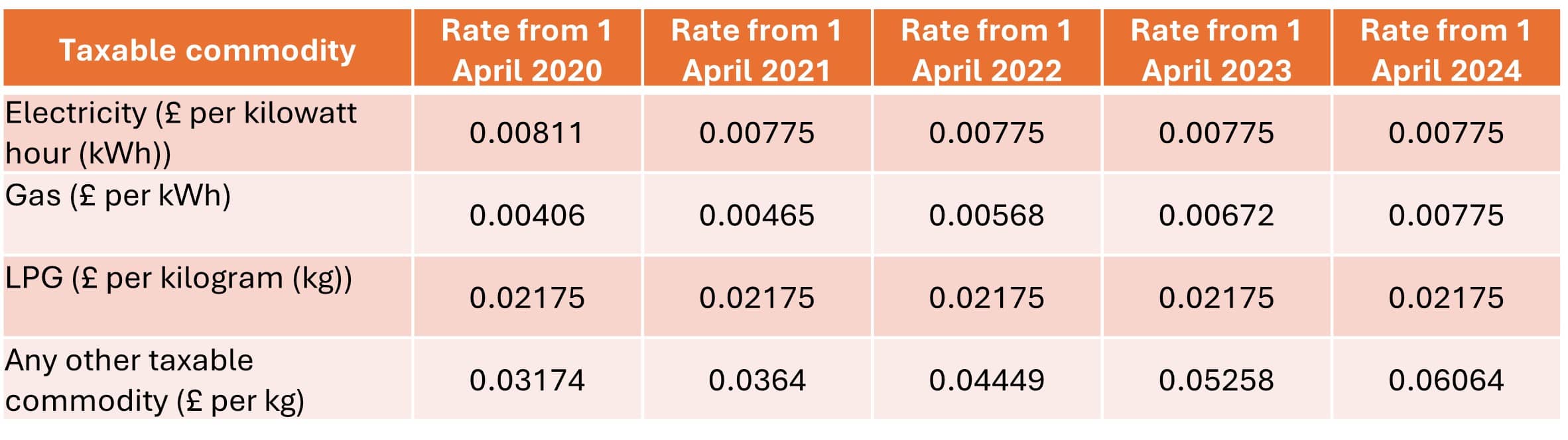

Latest CCL ChargesLatest CCL Charges (Climate Change Levy) a tax on energy delivered to business users in the UK

The Climate Change Levy (CCL) is a tax on energy delivered to non-domestic users in the United Kingdom. Its aim is to provide an incentive to increase energy efficiency and to reduce carbon emissions, however there have been ongoing calls to replace it with a proper carbon tax. Introduced on April 1st, 2001 under the Finance Act 2000 it was forecast to cut annual emissions by 2.5 million tonnes by 2010, and forms part of the UK’s Climate Change Programme. The levy applies to most energy users, with the notable exceptions of those in the domestic and transport sectors. Electricity generated from new renewables and approved co-generation schemes is not taxed although electricity from nuclear energy is taxed even though it causes no direct carbon emissions.

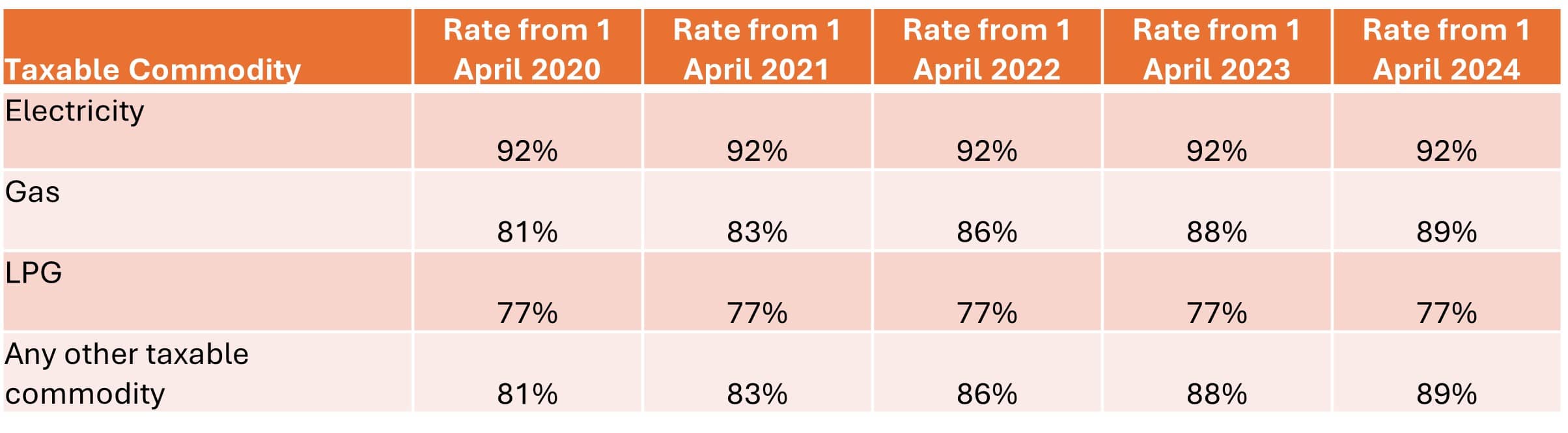

Climate Change Levy Reduced Rates

From the 1st April each year the Government increase the CCL Charges (Climate Change Levy). This means that for any energy used where CCL applies, it will be charged at the new rate from this date onward, and on the previous rate prior to this date.

From the 1st April customers will see the new charges for CCL on their bill for their business electricity and gas consumption. If a customer’s bill is for a period that crosses the CCL rate change, both the old and new rate will be shown and they’ll be charged the correct rate for the date the energy was used.

Further Advice

HM Revenue and Customs is responsible for publishing the active CCL rates and planed ammendments to the rates. A general guide to Climate Change Levy is available at www.hmrc.gov.uk (click on the ‘Environmental taxes’section of ‘Excise and other’). The CCL is added to energy bills before VAT and, although there is no legal requirement to itemise it, it often appears as a separate item on bills.

The Mineralogical Metallurgical Exclusion (MinMet)

Depending upon eligibility the MinMet exclusion provides a discounts for CCL charges, and potentially full CCL depending upon processes and methods.

A business can make the most of recent legislative changes by gaining fiscal relief from the CCL, allow our experts to assess your companies viability for a Mineralogical and Metallurgical exclusion and potentially save thousands of pounds.

We will manage the application process while you sit back and receive the benefits.

Who Pays CCL Charges?

The Climate Change Levy or CCL charge is an environmental tax on commercial electricity and gas use. It was originally designed to encourage businesses to be more energy efficient in how they operate by taxing them an environmental fee on all energy consumed.