- November 9, 2016

- Posted by: Catalyst

- Category: Business Energy News

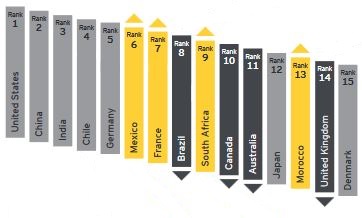

The UK has dropped down to 14th place in EY’s quarterly index of the most attractive locations for renewables investment – its lowest position to date.

The report, issued on 26 October, explained that European countries had become increasingly attractive to renewables investors in recent months, having lost pace with emerging markets earlier in the year. But the UK was said to be “bucking the trend” towards this overall improvement, mainly as a consequence of the uncertainty caused by the vote to leave the EU, the dismantling of the Department of Energy and Climate Change, and the approval of the Hinkley Point C nuclear power project. These factors had undermined confidence among investors.

However, the report highlighted the “continuing potential” of offshore wind in the UK. For example, it noted that Hornsea Project Two would become the world’s largest offshore windfarm, if built as planned. It further cited figures from the UK Crown Estate that suggested that offshore wind was on course to supply 10% of the country’s electricity demand by 2020.

EY concluded that the UK was left facing “an unknown future” ahead of Brexit negotiations, adding that “the deepest and most easily deployable technologies of wind and solar seem to be absent from the government’s plans” at this time.

European improvement

Meanwhile, many European countries climbed the rankings – including France, Belgium, Sweden, Ireland, Norway and Finland. This was credited to an increase in renewables programmes, which are helping to drive investment.

Ben Warren, EY global power and utilities corporate finance leader and chief editor of the report, said: “European countries lack the flexibility that exists in emerging markets to transform their energy industries. Their greatest hurdle is integrating renewables with historically centralised conventional power generation. It began to look like European countries were scaling back their renewables ambitions as a result but, in recent months, we’ve seen promising new programs materialise around the continent.”

The report underlines the pressure on the government to make a clear show of intent with regards to its long-term commitment to renewables funding. This month’s Autumn Statement could provide more clarity.