Energy Market Brief – August 2019Day-ahead gas and power at 20 and 18-month lows

Day-ahead gas prices increased for the first time since September 2018, rising 7.1% to average 30.0p/th in July. The contract peaked at 38.3p/th on 15 July, a three-month high as the gas system was undersupplied following an unplanned outage at Aasta Hansteen in Norway and a rise in gas for power demand amid forecasts of lower wind generation. August 19 gas also recovered, rising 4.2% to average 29.8p/th. All seasonal gas contracts rose, up 2.2% on average. Winter 19 gas was up 0.3% to average 51.5p/th, however this remains 12.8% lower than the same time last year (59.0p/th).

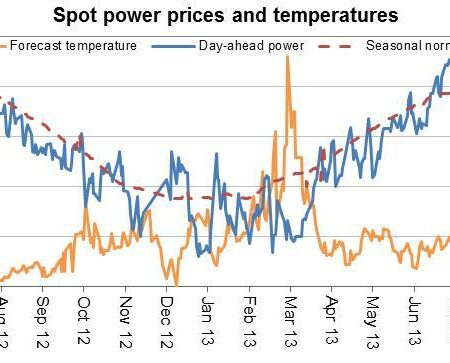

Day-ahead power rose for the first time since December 2018, growing by 6.2% to average £41.9/MWh in July. The contract also peaked on 15 July, hitting £48.8/MWh, the highest since 22 February as wind output was forecast below 1.0GW the following day. August 19 power gained 4.8% to average £41.1/MWh, however this a 14.0% reduction from the same time last year (£47.8/MWh). All seasonal power contracts also moved higher, up 3.2% on average, with winter 19 power 2.2% higher at £56.9/MWh.

Day-ahead gas hits two-year low, all contracts fall

EU ETS carbon prices rose for the first time in three months, gaining 11.2% to average €28.0/t in July. Carbon prices hit a 13-year high of €29.95/t on 24 July, supported by lower wind generation and the forecast of hotter temperatures in north west Europe. Weaker wind output, the unavailablity of nuclear plant in France, and higher cooling demand during record breaking temperatures, led to an increase in conventional power generation, pushing up demand for allowances. Certificate volumes in auctions will also halve in August to 33mn and should tighten supplies.