Energy Market Brief – June 2019Day-ahead gas and power at 20 and 18-month lows

Day-ahead power dropped by 6.0% in May to average £41.1/MWh, its fifth consecutive monthly decline. The contract ended the month at £35.6/MWh, a near two-year low. Prices continued to follow the gas market lower, with periods of high wind and solar generation also pressuring prices. All seasonal power prices fell in May, down 2.3% on average. Winter 19 power moved lower by 1.6% to average £57.8/MWh, 5.5% higher than May 2018 (£54.8/MWh).

Day-ahead gas declined for the eighth consecutive month, losing 10.2% to average 31.9p/th in May. The contract ended the month at a one-month low of 27.5p/th, as warm temperatures dampened demand, leaving the gas system oversupplied. The gas system has continued to remain oversupplied this year due to the influx of LNG to GB terminals. A total of 16 tankers arrived in May, down from 19 in April. All seasonal gas contracts reversed the previous month’s gains, falling 3.0% on average, following a decline in Brent crude oil prices. Winter 19 gas decreased 3.1% to average 54.5p/th, 3.3% lower than in May 2018 when the contract averaged 56.8p/th.

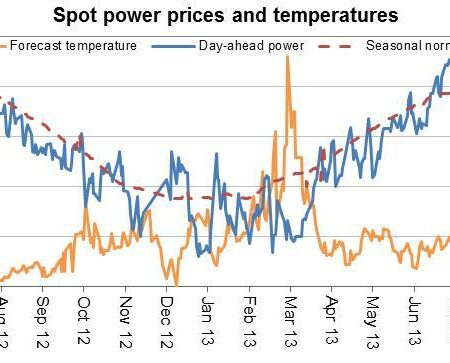

Warmer weather pressures wholesale prices

Brent crude oil declined for the first time this year, down 1.3% to average $70.5/bl in May. Oil prices ended the month at $64.9/bl, the lowest since mid-February, amid concerns that the ongoing US-China trade war will lower demand for oil. Concerns of weaker demand are more than offsetting previous worries of a tighter market following OPEC+ production cuts, with the cartel now expected to continue the cuts beyond June 2019.