Energy Market Brief – November 2020Near-term gas contracts rose in October, as prices found support from a general decline in temperatures as we progress into winter, alongside 20-month high LNG prices. However, price growth was dampened with the implementation of fresh lockdown restrictions, weighing on demand.

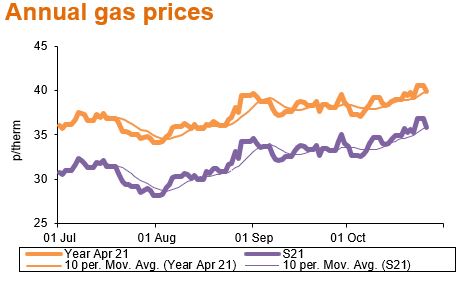

Annual Gas Prices

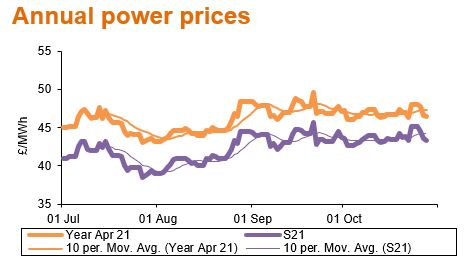

Annual Power Prices

Near-term gas contracts rose in October, as prices found support from a general decline in temperatures as we progress into winter, alongside 20-month high LNG prices. However, price growth was dampened with the implementation of fresh lockdown restrictions, weighing on demand.

Seasonal contracts from winter 21 to summer 23 fell 1.0% on average. The contract for delivery in winter 21 fell 0.7% to average 43.08p/th, with the summer 22 contract down 0.5% to 35.62p/th. The annual April 20 contract increased lifting 1.0% to 38.78p/th.

Gas prices will struggle to find much support in the near future, as gas markets remain well supplied and fears of oversupply remain in the linked oil market alongside demand uncertainty.

All near-term and long-term power contracts experienced declines, indicative of an uncertain demand picture ahead.

All seasonal power contracts up to and including summer 23 fell, following seasonal gas prices lower. Similar to gas prices, growth stagnated alongside commodity markets and economic uncertainty surrounding COVID-19.

The summer 21 contract fell 0.4% to average £43.60/MWh, with the winter 21 contract slipping 2.4% to £50.09/MWh. The summer 22 similarly declined following other seasonal contracts lower, reducing 2.7% to £43.64/MWh.