Energy Market Brief – February 2021Gas prices, both for near-term delivery and longer-dated contracts, saw notable gains across January. Prices have been supported by below average temperatures, acting to lift heating demand, alongside rising oil and LNG prices amid positive COVID-19 vaccination developments. Offsetting further gains were continued nationwide lockdown restrictions across England and much of Europe.

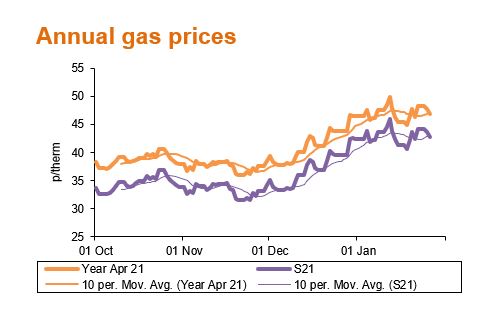

Annual Gas Prices

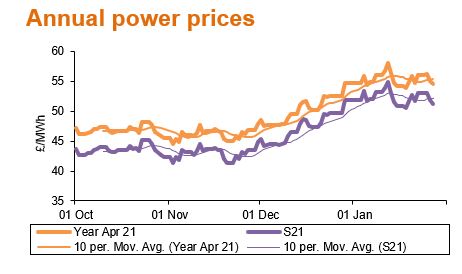

Annual Power Prices

Gas prices, both for near-term delivery and longer-dated contracts, saw notable gains across January.

Prices have been supported by below average temperatures, acting to lift heating demand, alongside rising oil and LNG prices amid positive COVID-19 vaccination developments. Offsetting further gains were continued nationwide lockdown restrictions across England and much of Europe.

All near-term and long-term power contracts experienced growth in January, following gas prices higher.

Power prices continued to find support from tight supply margins, prompted by several power plant outages, high demand levels and low wind output. This even led to National Grid ESO issuing three Electricity Margin Notices (EMN) in the month. An EMN is issued when plant capacity is forecast to fall below National Grid’s margin threshold.

As a result, recent power prices at the day-ahead level have been very volatile, leaving suppliers more exposed to unexpected price spikes, exceeding £1,000/MWh in some hourly periods.