Energy Market Brief – September 2020Seasonal power contracts up to and including summer 21 increased, following gas prices upwards and amid bullish sentiment for energy prices this winter

Annual Gas Prices

Annual Power Prices

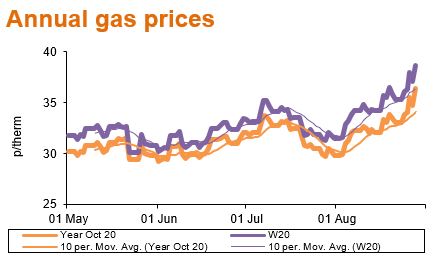

Most commercial gas contracts rose in August, as prices were supported by resurging demand and higher commodity prices, including seven-month high LNG prices and a near five-month high oil price.

Seasonal contracts from winter 20 to winter 22 rose 1.1% on average. The contract for delivery in winter 20 lifted 6.0% to average 35.13p/th, while the summer 21 contracts rose comparatively less, up 1.2% to 30.83p/th. The annual October 20 contracts increased 3.7% to 32.98p/th.

Seasonal gas prices will struggle to find much support in the next month, as gas markets remain well supplied with gas storage levels looking healthy as we enter Autumn.

Near-term and long-term power contracts experienced diverging trends in August.

Seasonal power contracts up to and including summer 21 increased, following gas prices upwards and amid bullish sentiment for energy prices this winter. In contrast, contracts thereafter declined, following a drop in EU ETS carbon prices and a comfortable supply picture as more renewables generation capacity commissions.

The winter 20 contract gained 3.7% to average £47.51/MWh, while the summer 21 contract went up 0.3% to average £41.18/MWh. Winter 21 power dipped 1.6% to average £48.71/MWh.