October 2022 Energy Market BriefCollectively bearish movements across all tracked wholesale gas and power contracts

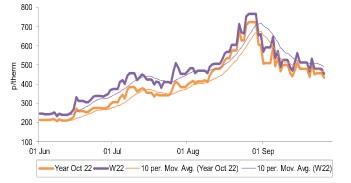

Annual Gas Prices

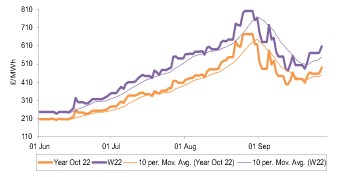

Annual Power Prices

In September, we observed collectively bearish movements across all tracked GB wholesale gas contracts. Shorter dated contracts such as the day-ahead and front-months observed the most prominent losses month-on-month, with slightly softer price decline further out on the forward curve.

On average, seasonal gas contracts from winter 22 to summer 24 were 7.4% lower in September compared with the previous month. Despite losses, the winter 22 gas price still remains the highest priced seasonal contract averaging 521.64p/th in September and 480.0% higher than September 2021.

Factors influencing the bearish movements of GB wholesale gas contracts in September were varied. Starting with physical gas supplies, we observed relatively uninterrupted flows from Norway in the month, coupled with a steady outturn of UKCS domestic production and higher trending LNG cargo deliveries to UK terminals from multiple regions.

The strong downward momentum on near-term domestic gas prices set a bearish direction for power prices to follow. The continuation of higher levels of exports via our interconnectors to Europe remained prevalent in September, as interconnected markets such as France, Germany Norway and Belgium continue to observe higher power prices compared with GB on average, both in the shorter-term and contracts further out on the forward curve.

Front-month power contracts (October and November 22) shared the price direction of their gas counterparts and day ahead power prices, subsequently falling 19.8% on average to sit at £357.63/MWh and £646.79/MWh, respectively.

Like gas and power contracts, tracked international commodity markets also recorded losses in September. Both the UK and EU ETS carbon markets fell, with the UK ETS down 8.8% to average £80.43/t, while the EU ETS dropped 17.9% month-onmonth to average €70.57/t.