December 2022 Energy Market BriefPrices are beginning to curve back up

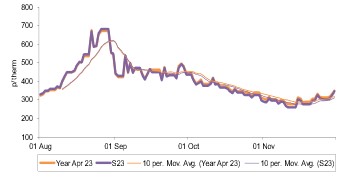

Annual Gas Prices

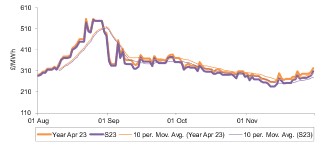

Annual Power Prices

In November, we observed near-term pricing (particularly on the day-ahead contract) return to bullish growth, after recorded losses observed in October. We continue to observe a marked divergence between day-ahead contract prices and those further out on the forward curve, which continue to trade at a comfortable premium, particularly into Q123. A higher level of price risk remains baked into longer-dated contracts as we approach the heart of the winter season without the significant and equally historic contribution of Russian natural gas.

Despite this, on average, seasonal gas contracts from summer 23 to winter 24 were 14.9% lower in November compared with the previous month. Winter 23 gas prices represented the highest average contract price in November at 315.18p/th.

Competing market fundamentals were reflected in price movements in November. We attribute the predominant bullish price movements at the day-ahead level particularly in the latter half of the month.

We observed tight system margins across 28 and 29 November where wind outturn was notably low, placing higher reliance on more expensive gas-fired generation plant called upon to meet demand, with the last three days of November seeing day-ahead prices average 315p/th, ~133% higher than the month average. Bearish market drivers remained consistent in November overall, capping price rises, with a strong influx of LNG continuing to reach UK landing terminals

and supporting the immediate supply/demand picture.

Day-ahead power prices follow their gas counterpart higher – up 19.9% on average to sit at £156.52/MWh. Despite this, prices were still ~24% lower than the same reporting period of 2021.

Elsewhere, seasonal power prices were also down 11.3% on average from summer 23 to winter 24. The strong upward momentum on near-term domestic gas prices set a bullish direction for power prices to follow. The

continuation of higher levels of exports via our interconnectors to Europe remained prevalent in November, as interconnected markets such continue to observe higher power prices compared with GB on average. Much like gas, the tail-end of November represented significantly elevated prices to the monthly average.

On Tuesday 29 November, National Grid ESO issued a Capacity Market Notice (CMN), amid expectations that demand would outstrip supply by 177MW from 7pm. This saw N2EX day-ahead hourly prices of £1,000/MWh expected for the evening. The CMN was subsequently cancelled later that day.

Brent crude price slipped 1.6% lower to 91.98/bl, including a near one-year low of $81.00/bl on 28 November. Concerns over demand levels in China, amid heightened COVID-19 lockdown measures, curbed prices in the month – particularly as China is one of the largest importers of crude oil globally. Elsewhere, carbon markets in both the UK and Europe registered mixed movements.

The EU ETS climbed 8.3% higher to €75.61/t whereas the UK ETS fell 3.0% to £70.75/t.