November 2022 Energy Market BriefIs the bull run in the Energy Market over for the moment

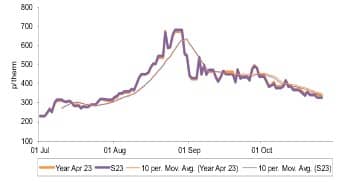

Annual Gas Prices

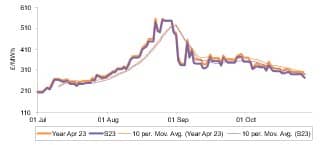

Annual Power Prices

In October, we observed bearish movements across all tracked GB wholesale gas contracts, representing a second consecutive month of average price decline. However, contracts further along the forward curve remain at significantly elevated levels with continued risked baked into forward prices, resulting in a notable spread between day-ahead prices and longer dated contracts.

On average, seasonal gas contracts from summer 23 to winter 24 were 10.2% lower in October compared with the previous month. The winter 23 gas contract represented the highest average contract price in October at 381.07p/th.

Losses month-on-month for gas contracts were relatively consistent throughout October, influenced by more prevalent bearish market drivers overall. The month outturned as one of the mildest on record, with the first ten months of 2022 trending as the UK’s warmest year since 2014. Warmer temperatures have eased demand for gas and fossil fuel fired assets to meet demand, which are typically more expensive forms of generation, which has allowed prices to soften in the near-term. From a supply point of view, the UK and Europe continue to receive consistent LNG cargo deliveries and high levels of volume, helping to soften the supply/demand balance in the short term entering the winter season. EU gas storage reserves are also closing in on 100% fullness, easing some concerns of Russian gas dependency entering the highest demand period of the year.

As a result of the aforementioned bearish drivers for gas prices, we saw day-ahead gas drop notably, down 59.4% to average 109.53p/th, including a ~five month low of 40.00p/th on 18 October. Front-month contracts were also down 36.2% on average from September, with November 22 averaging 252.52p/th and December 22 at 397.70p/th.

October saw day-ahead power prices follow their gas counterpart lower – down 52.9% on average to sit at £130.55/MWh. Prices now down 31.3% on average from 2021.

The strong downward momentum on near-term domestic gas prices set a bearish direction for power prices to follow. The continuation of higher levels of exports via our interconnectors to Europe remained prevalent in October, as interconnected markets such as France, the Netherlands and Belgium continue to observe higher power prices compared with GB on average. Total wind generation was also up ~51% on September, softening near-term supply margins in October.

November 22 and December 22 power contracts shared the price direction of their gas counterparts and day ahead power prices, subsequently falling 26.5% on average to sit at £382.14/MWh and £537.47/MWh, respectively. Additionally, seasonal power contracts also lowered 11.9% on average against September.